The prospect of Amazon entering the banking sector has sparked significant interest and speculation among financial technology (fintech) companies. As one of the world’s largest and most innovative tech giants, Amazon’s potential move into financial services—often referred to as the “Bank of Amazon”—could reshape the competitive landscape. However, rather than viewing Amazon as a threat, many fintech companies see its entry as a net positive for the industry.

With Amazon’s vast customer base, technological expertise, and commitment to innovation, its foray into banking could accelerate the development and adoption of digital financial services. Fintechs believe that Amazon’s involvement could drive collaboration, enhance customer experiences, and expand access to financial services.

Why Fintechs See Amazon as an Opportunity

While some traditional banks may view Amazon’s potential entry into banking as a disruption, fintech companies are more likely to view it as an opportunity for growth and partnership. Fintechs and Amazon already share a common focus on customer-centric innovation and leveraging technology to deliver better financial products and services.

Here’s why fintechs see Amazon’s entry as a net plus:

- Expanding the market: Amazon’s massive reach and influence could bring financial services to millions of underbanked or underserved customers, especially in regions where traditional banks may struggle to gain a foothold. Fintechs could benefit from increased market demand for innovative solutions to serve these customers.

- Collaboration opportunities: Fintech companies may have opportunities to partner with Amazon, providing specialized technology or services that Amazon could integrate into its banking offerings. These partnerships could help fintechs scale quickly and gain access to Amazon’s customer base.

- Driving innovation: Amazon is known for pushing the boundaries of innovation in every industry it enters. Its entry into banking could lead to a wave of new digital financial products and services, driving fintechs to enhance their own offerings and develop new technologies to stay competitive.

How Amazon Could Change the Banking Landscape

Amazon’s potential move into banking would likely focus on offering digital-first, customer-centric financial services that prioritize convenience, ease of use, and low fees. Much like its approach to retail, Amazon would aim to simplify the banking experience, leveraging its tech infrastructure to offer seamless payment, lending, and savings solutions.

Key areas Amazon could disrupt include:

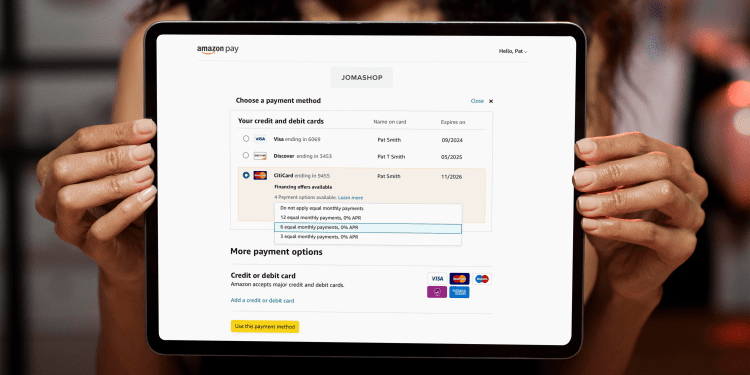

- Payments: With its vast e-commerce ecosystem, Amazon already has experience handling payments on a massive scale. By offering payment services such as checking accounts, digital wallets, or even its own credit card, Amazon could provide a unified financial ecosystem for consumers, streamlining how they manage their money and shop.

- Lending: Amazon has already dipped its toes into small business lending, offering loans to sellers on its platform. Expanding its lending services to include consumer loans or business financing could pose a challenge to traditional banks, but fintechs specializing in lending technology could see this as an opportunity to collaborate.

- Banking services: Amazon could offer checking or savings accounts, eliminating the need for customers to visit physical branches. This would align with fintech’s mission to provide digital-first banking experiences, offering a fully online banking model.

Potential Challenges for Fintechs

While fintech companies are generally optimistic about Amazon’s potential entry into banking, there are some challenges to consider. Amazon’s immense resources and market dominance could pose a competitive threat to smaller fintechs that may struggle to keep up with its scale. Additionally, if Amazon were to develop proprietary financial technology in-house, it could reduce the need for fintech partnerships.

However, many fintechs are confident that their niche expertise and innovative approaches will allow them to complement Amazon’s offerings rather than compete directly. By staying agile and focusing on specific market needs, fintechs can carve out valuable roles within Amazon’s broader financial ecosystem.

The prospect of the “Bank of Amazon” is seen by many fintech companies as a net plus, offering opportunities for collaboration, innovation, and market expansion. With Amazon’s potential to disrupt traditional banking and enhance the digital financial services landscape, fintechs are well-positioned to benefit from its entry into the sector. By working together with Amazon, fintech companies can continue to drive innovation, improve customer experiences, and expand access to financial services for more consumers around the world.