An article in India Times reported that ATM cash withdrawals are increased 22% from the previous year while debit card transactions at the point-of-sale increased 24% from the previous year, according to the Reserve Bank of India. Both cash and electronic payments go hand in hand. The frequency of cash withdrawal, as well as the cash amount being withdrawn, is rising, a sign that the economy is improving.

“We have noticed that per day transactions at our ATMs have gone up as well and so has the average ticket size of each withdrawal,” said Navroze Dastur, managing director for India and South Asia at NCR Corporation. “This goes on to show that both cash and digital as modes of payment will simultaneously exist and no one will replace the other mode of transaction,” he said.

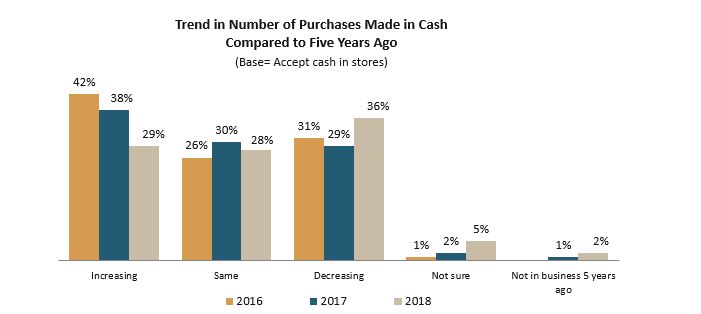

Cash use in the U.S., while strong is maintaining a stable position. In an upcoming report to be released from the U.S., Mercator Advisory Group’s Small Business Payments and Banking Survey Series’ report, Payment Acceptance As Digital Channels Expand, more small businesses noticed that cash use is decreasing compared to five years ago, in a marked diversion from 2016 and 2017, when 2 in 5 businesses reported cash use had been increasing. Much of the focus on small businesses lately have been to increase the use of digital channels, particularly for sales, where card payments are more important. In our survey, small businesses are just as likely to sell in physical locations as through online channels.

Overview by Karen Augustine, Manager of Primary Data Services at Mercator Advisory Group