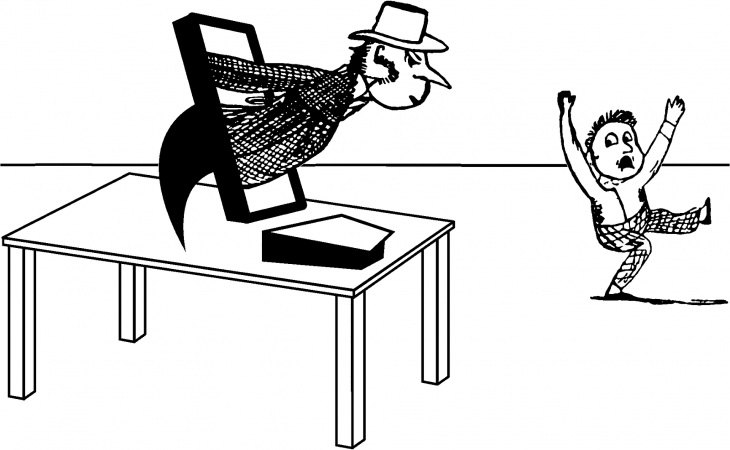

Has your child received pre-approved credit card offers in the mail? Has a collection agency called you asking for payment on an account they opened? Or have you been offered guaranteed low interest rates on loans? If so, don’t ignore those letters: Your child may be the victim of identity theft.

Experian’s recent Child Identity Theft Aftermath Survey found the average child identity theft victim is 12 years old when their identity is stolen.

The majority of child victims believe their identity was first stolen when they were over the age of 10, and nearly half say it occurred between the ages of 15 and 17.

While child identity theft is still not as common as other types of ID theft, it is very lucrative for thieves because there is typically no credit history established for the children who become victims. Once scammers get a hold of a child’s Social Security number or other personal information, they can open new bank or credit card accounts, take out loans, and apply for government benefits.

To raise awareness of child identity theft and the corrosive impact it can have on families,Experian has designated Sept. 1 to be “Child Identity Theft Awareness Day.” The publisher of this blog also has a family identity protection plan to help parents monitor their children’s personal information and protect against fraud. The first step is to know how to protect your child from identity theft and understand where identity thieves are looking for personal data.

How Is Child Identity Theft Discovered?

More than 1 million children were the victim of identity fraud in 2017, resulting in losses of $2.6 billion and more than $540 million in out-of-pocket costs to the families, according to Javelin Strategy & Research.

According to Experian’s survey, over half of victims discover the theft themselves, and many are 18 years or older by that time. Discovery of fraud primarily occurs when child identity theft victims apply for credit as an adult, or when they receive an unexpected bill or credit card in the mail.

Who Is Responsible for Child Identity Theft?

One of the unfortunate realities of child identity theft is that 37% of victims never found out who responsible for the crime. But 33% of the time, victims discover that they know the perpetrator, and in those cases, a parent or other family member is typically responsible.

Additionally, 2 out of 3 child identity theft cases result in the victim’s Social Security number, name or date of birth being compromised.

Of the responses from victims or their parents, 70% said they most often report the identity theft to the credit issuers or collection agencies who mistakenly billed them. While 62% said they reported the identity theft to local law enforcement. Still many cases of child identity theft go unreported, as less than half said they filed a police report during the resolution process to actual law enforcement.

How Long Does Recovery from Child Identity Theft Take?

The time it takes to resolve identity theft is considered to be the worst part of it all, according to 82% of respondents in our survey.

The resolution process can drag out for years and 25% of victims are still dealing with issues over 10 after the fraud first occurred. Of those victims, 81%, still remain worried today about their ability to obtain credit in the future and 82% agree they are concerned this could happen to them or another family member again in the future.

How to Protect Yourself from Child Identity Theft

Looking back, 63% of victims wish their parents had done things differently to protect them, but they also believe parents are not informed enough to do a good job of protecting children today. Make sure you understand how to check your credit report for ID theft and be on guard against all types of identity theft that can occur.

Here are five ways to safeguard your children’s identity:

- Don’t Be Afraid to Leave out Sensitive Information When Completing Certain Forms

Parents are asked to complete dozens of forms for their kids. It can be easy to go on autopilot when filling them out, but parents need to stay vigilant, says Eva Velasquez, president, and CEO of the Identity Theft Resource Center.

“We get into form fatigue because you’re just filling stuff out left and right, whether it’s for school activities, clubs, health forms, emergency contacts and the like,” Velasquez, says. “But a lot of times, they don’t need the most sensitive identification credentials. You can leave them blank.”

For example, if an after-school activity requires your child’s Social Security number, you don’t necessarily have to give it to them. Err on the side of withholding the most sensitive information, like Social Security numbers and the like, suggests Velazquez.

- Ask Questions About How Information Will Be Used and Secured

Some programs will require your child’s Social Security number, including federally-funded after-school programs that require SSNs to get their allocated funding,

But it’s your right as a parent to find out how it will be used and, most importantly, how the collector plans to store the data. Will the information be stored in a secured facility?

Sometimes the answer is enough to direct you to provide an alternative. For example, if someone is asking for your kid’s SSN to prove age, you can refer them to school records. If a sports team is requesting your family’s insurance information including group and ID numbers, get reassurance that the data is housed in a secure way and not, as Velazquez puts it, “tossed in a Tupperware box in the coach’s trunk.”

- Be Careful About Copies of Important Documents

Some activities or organizations will ask for copies of important documents like your child’s birth certificate. You don’t have to leave it with them. If they need it to verify age, let them know you’re happy to show a copy of the document for verification, but there’s no need to store it with them.

“There are a lot of things, as consumers, that are out of our control,” says Velazquez. “But limiting self-exposure is one thing you can control.”

- Beware of Child Identity Protection Kits

Schools or PTAs often promote child identity protection kits that are used to gather information that could be helpful in the event your child goes missing. Be careful about what kind of information you include in these, especially if you’re not going to house the data yourself.

For example, some kits might ask for your children’s fingerprints. This isn’t really useful if your child is missing. And with the rise of biometric markers to confirm identity, it could be used maliciously if it falls into the wrong hands.

“Parents might feel better, but it’s really a false sense of security,” says Velazquez. “You don’t want to make your children vulnerable to another type of crime by giving out this information.”

- Secure Your Documents at Home

You owe it to your family to make sure important data is stored in a safe place at home, as well. Keep valuable papers like birth certificates, Social Security cards and medical records in a locked file cabinet that can’t be easily lifted by thieves. Try to store it in a place in your home that is not heavily trafficked, adds Velazquez.

For more information on how to protect your child from identity theft, visit our guide here.

About the Author

By Matt Tatham, manager of content insights and data analyst at Experian Consumer Services