Let’s stop spreading FUD (fear, uncertainty and doubt). Here are 8 blockchain and cryptocurrency myths debunked.

Myth #1: Blockchain is about digital currencies

Many early applications that captured headlines and brought speculators were digital currencies, including Bitcoin, Litecoin and Ethereum. However, blockchain technology is not limited to just cryptocurrencies.

On one hand, open, permissionless blockchain networks like Bitcoin and DASH are cryptocurrency solutions that aim to provide global, frictionless payments without a middleman. The other popular use is allowing teams crowdfund their new projects and launch a crypto token to power their network. Though there are many regulatory grey areas, initial coin offerings have surpassed $12B USD, dwarfing traditional VC funding channels.

On the other hand, permissioned distributed ledger solutions like Corda, Quorum and Hyperledger do not create native digital currencies. Rather, they address practical use cases like tracking the integrity of goods through supply chains or expediting trade finance. These architectures are more suitable for heavily regulated enterprises with legacy systems and processes.

Myth #2: Regulators want to take down cryptocurrency markets

Despite concerns that regulatory authorities would come down hard on cryptocurrencies, the U.S. SEC and CFTC share optimism about the technology. But they also share a concern that initial coin offerings lack sufficient oversight and protections against scams and frauds that prey on retail investors. From a global perspective, regulations evolve differently based on jurisdiction and public understanding of the technology. For instance, China’s ban on crypto and ICOs may be very aggressive compared to Japan, but China’s views may change over time with a preference for fostering responsible innovations rather than a one-size-fits-all approach.

Myth #3: Blockchain transactions are anonymous

Contrary to popular perception, transactions on permissionless, open blockchains like Bitcoin are not anonymous. Rather, Bitcoin users use pseudonyms for transactions. Transactions are shared on its global public ledger, making user identities vulnerable to discovery.

One can argue blockchain has a fundamental need for privacy. Transaction privacy is crucial in many areas, such as healthcare, financial trading desks, and sensitive supply chains. This is why there are cryptocurrencies that offer privacy enhancing technology which Bitcoin can’t provide. For instance, Zcash enables transaction privacy with advanced cryptographic methods called zero knowledge proof. Monero is a digital currency that uses the public blockchain but implements a mix of privacy features to ensure transactions are anonymous, including ring signatures and stealth addresses. This aims to solve the problem of funds being traceable thereby providing complete anonymity for senders and receivers.

Myth #4: Blockchain only benefits startups and new market entrants, not incumbents

Depending on the design choice, blockchain solutions can offer massive potential for established players, not just new startups looking to disrupt traditional models. For instance, reverse initial coin offerings (ICOs) is a way for existing businesses to raise funds on the blockchain that changes its business from a centralized and fiat based model to decentralized and virtual currencies. The business can tap the benefits of blockchain by decentralizing the architecture while shifting to a tokenized economy.

For example, Kik is a popular social media app with millions of users. It raised closed to $100 million in an ICO that launched the KIN token to be used on its ecosystem. Users can earn and spend KIN tokens, as well as trade it on an exchange for other crypto tokens. Telegram, the popular secured messaging app, is also launching the blockchain-based TON network that uses the Gram crypto to enable services such as payments, file storage, and other decentralized apps.

Beyond the reverse ICO trend, large financial institutions are using this technology to achieve cost savings and efficiency gains by removing pain points from markets like cross border payments and trade finance. Financial enterprises are not necessarily introducing new cryptocurrencies but are attacking problems with legacy infrastructure that has created massive inefficiencies, duplications, and unnecessary reconciliation.

Myth #5: It’s too late to enter cryptocurrency markets

This fear of missing out is correlated with crypto prices, particularly Bitcoin. Newcomers feel Bitcoin is too expensive. In reality, Bitcoin is divisible so that 1 Bitcoin can be divided into 100 million satoshis (the smallest Bitcoin unit). It means one can purchase a super small fraction of a Bitcoin just like you can own a piece a of a gold bar by investing in a Gold ETF to get exposure. Also, people often miss the value proposition of major cryptocurrencies.

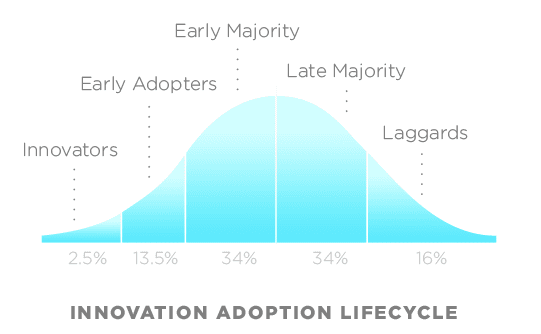

For instance, Litecoin aims to provide faster, more scalable payments than bitcoin. Meanwhile, Ethereum is a global computing machine with smart contracts that allow developers to build decentralized applications on top without the need for intermediaries. Ripple aims to facilitate cross-border payments for financial institutions. We’re still in the early days of cryptocurrencies and even earlier in the token economy. We can look to the innovation adoption lifecycle as a rough guide to extrapolate. One view could suggest we’re somewhere around the early majority stage. One thing is certain – no one can sure which cryptocurrency will be the dominant one in 5-10 years.

Myth #6: Blockchain is too complicated

Jargon can throw people off. At its core, blockchain is simply a decentralized database that stores data in a way that everyone on that network has read and write access to it but no one user can manipulate it.

Transactions on this network are updated in real time (or near-real time), allowing users to see the same copy of the data (what you see is what I see). All this occurs without a middleman. Therefore, there’s no single point of failure. The revolutionary part is the ability to write decentralized applications that can alter the behavior of businesses and how society functions, while changing the way we transfer anything of value–not just money.

Myth #7: Cryptoeconomics is technical analysis or a method from economic textbooks

Cryptoeconomics is not market analysis with candlestick charts. It’s also not quite a field of micro- or macroeconomics. There’s a mix of cryptography and behavioral economics. Rather, as John Starks puts it: “cryptoeconomics is the use of incentives and cryptography to design new kinds of systems, applications, and networks.”

To ensure that a blockchain like bitcoin is secured, its protocol incentivizes network users to expend computing to secure the network in exchange for financial rewards. In DASH, masternodes help enable instant transactions and privacy features. To run a masternode, users must stake a sizeable amount of crypto funds as collateral, and in exchange they’ll receive recurring payouts from the DASH network.

Myth #8: You can create a token for anything

It’s true now there are standards, Github templates and even business services that allow users to create tokens on a blockchain within a short time frame. But if it has little value proposition to your network, likely it won’t be sustainable. Teams can no longer launch a token offering and crowdfund based on a whitepaper and stunning website. Due to the hype cycle, investors grow wary and more informed about the value proposition of distributed networks. The key questions to ask before launching a token is:

- what is the purpose of the token;

- what function does it perform;

- is there a credible token economics model;

- is the token super critical to the network;

- why blockchain (not everything belongs on a blockchain)