In the past few years Merchant Acquiring – a hitherto stagnant field – has experienced a rebirth and has been at the forefront of discussions on digital transformation, disruption, disintermediation and any other buzzword you can find in the thesaurus of the payments world. Acquirers have bolstered their product teams and made forays into omni-channel acceptance and various value added services.

The resulting hype has led to more banks considering moving into the acquiring space but, as the dust settles, the realization is also starting to set in that all this innovation and value addition has so far not led to improved margins or higher profits. Across the world acquirers continue to report shrinking margins and commission rates are in a race to the bottom.

Given the rise of specialist third part processors and payment service providers, traditional acquiring is now at the crossroads where retail banks need to re-evaluate traditional business models and decide whether they need to remain or withdraw from this space.

How it all began:

When credit cards were first introduced, an acceptance ecosystem needed to be put in place. As a result Merchant Acquiring was an essential requirement for any card issuing businesses. At the time, commission rates (charged per transaction) were high and maximizing on-us spend (where issuer and acquirer are the same bank) was the primary objective. Thus margins were healthier and the main KPI for a business was spend volumes.

As the industry grew and more issuing as well as acquiring banks arrived, the utility of merchant acquiring became increasingly unclear:

• Each bank was deploying identical solutions/technology and so the price competition drove commission rates lower

• The proportion of off-us transactions (of cards issued by other banks) kept increasing which really impacted profitability at lower commission rates

• Ever increasing premiumization and association fees caused costs to balloon

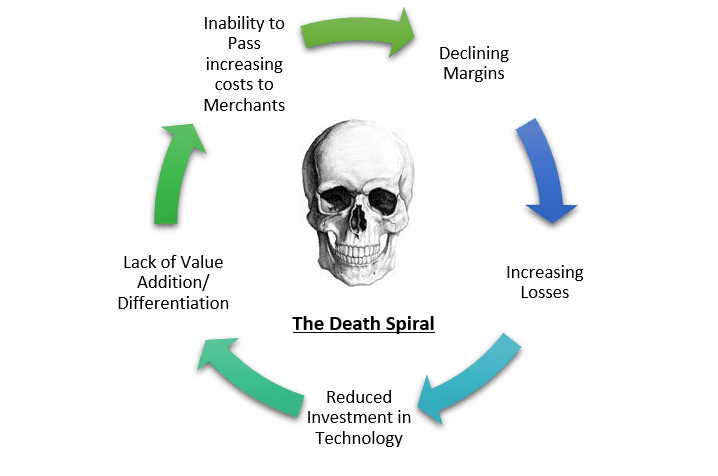

This brings us to where most acquiring banks are today: caught in a death spiral, losing money and unable to clearly articulate the financial and/or strategic utility of the business.

Is there a still a point to it?

Yes, sort of. Running an Acquiring Business is a headache at the best of times; there is usually a large physical value chain to manage and one must deal with significant credit and fraud risks. Given the razor thin margins involved, a couple of successful frauds can wipe out a significant portion of the business’s bottom-line. It thus becomes important that management clearly understand and vocalize spell out the strategic and financial value of the business to the bank.

In an effort to get an insight into what senior bankers perceive to be the strategic importance of merchant acquiring, we carried out a survey of executives and decision makers from the Middle East and South Asia. Some of the findings are shared below:

1. What should be the primary reason for a bank to be in the merchant acquiring business (please rate in order of importance)?

As can be seen from the responses, driving card spends is still a primary but not the standalone consideration for acquiring banks who expect it to generate revenue and also see it as an important tool to deepen relationships with corporate/transaction banking customers.

2. Your opinion on the relationship between merchant acquiring business and issuing portfolio spends market share?

Depending upon the respective strategic priorities of their businesses, respondents were split 54%/46% on the significance of the relationship between an acquiring bank’s issuing portfolio and its acquiring business. Those who see a significant relationship between the two contend that a bank’s card portfolio spends should be greater than 10% of the market for a bank to enter the merchant acquiring space.

3. In your experience, how many acquirers can a particular market sustain?

Given the commoditized nature of the services and simple supply/demand, increased number of acquirers in the market will adversely impact pricing and profitability. That 61% of respondents believe the number of acquirers is irrelevant is in keeping with the above response that shows numerous other considerations in addition to profitability.

i) ON-US spends:

The original reason for having an acquiring business, the percentage share of ON-US spend is a key driver of profitability of a merchant portfolio. Loyalty engagements and offers with partner merchants can drive card spends as well as create real value for the merchants. If a bank’s card portfolio is a significant portion of the market and/or the bank has significant ambition to grow spends, there is merit in being an acquirer.

ii) Dynamic Currency Conversion on International Spends:

Dynamic currency conversion (DCC) can be a significant line of income for merchant acquirers in markets with high international spends. International cardholders are offered the option of making a transaction in the local currency (in which case the issuing bank will charge a currency conversion rate) or in their home currency (in which case the acquiring bank will charge a currency conversion rate. For transactions where cardholders choose to pay in home currency, acquirers can make 1%-2%. At the same time, additional international acquiring charges by payment schemes can run up the interchange to above 2.5% on premium cards so transactions where cardholders do not opt for home currency are invariable lossmaking (unless the acquirer has sufficient pricing power to charge higher commission rates).

The takeaway would be that banks entering the space need to carefully consider building capability to process DCC transactions given a significant enough proportion of international spends as well as the expected percentage of cardholders opting in for DCC. The mix of nationalities is a key determinant of the projected opt-ins as the key determinant would be the prevalent currency conversion prices charged by issuers in each country. As a rule of thumb, acquirers can charge slightly higher than issuers in exchange for the greater transparency and convenience for cardholders to pay in their home currency.

iii) Customer Acquisition:

A strong payment acceptance suite can serve as a strong customer acquisition tool for a bank, which is why many banks tolerate losses from the acquiring business. Given the low switching costs, an acquirer with an advantage in acceptance products can effectively leverage its suite to get a foot in the door with major corporations and governments with a view to cross sell in the future.

To the question “Should Acquiring Banks should make it mandatory (to the greatest extent possible) for merchants to maintain a bank account with them?” The clear majority of the respondents were in favor of making account opening mandatory for merchants which reflects the importance of the business as a customer acquisition and ring-fencing tool.

Whilst customer acquisition is the most commonly cited strategic reason for staying in this space, there is often a gap in taking the next step towards actively measuring the economic benefit from this strategy.

• In countries where spreads are high, the bank should (market conditions permitting) try to maximize the number of merchants whose funds are settled into current accounts maintained with the acquiring bank.

• In countries where spreads are very low (developed countries) it is even more important to develop a cross-sell road map for customer acquisition and then track it over a reasonable period of time.

iv) Transaction Services:

Merchant Acquiring relates to Credit Cards which in most banks are the sole jurisdiction of Retail Banking. It naturally follows that the business and product owners’ primary perspective is in terms of credit card spends and related value addition in the form of discounts, offers and loyalty programs at retailers. An increasing number of banks are exploring ways to create synergy with Corporate Banking. In a few cases banks which have recently entered Merchant Acquiring have placed the business within Transaction Banking or as a separate “Payments Division” providing services to Retail and Corporate Banking. The advantages of this would be:

a) Customer Acquisition and ring-fencing: the corporate bank would be able to offer a comprehensive collections solution across cash, card and cheque payments in order to acquire new clients as well as deepen existing clients

b) Greater visibility and comfort with receivables: financing against credit card receivables (factoring) is a common facility for SME retailers and even for larger corporations, banks gain comfort with greater visibility of store-wise sales. Many acquiring banks mandate assignment of credit card sales proceeds to repayment accounts when providing financing to large corporations.

CONCLUSION:

Based on research and financial models, we have put down the key drivers of success in the merchant acquiring space in the simple checklist below:

At least 3 yeses combined with considerable patience in setting up a complex operation will be the formula for success.