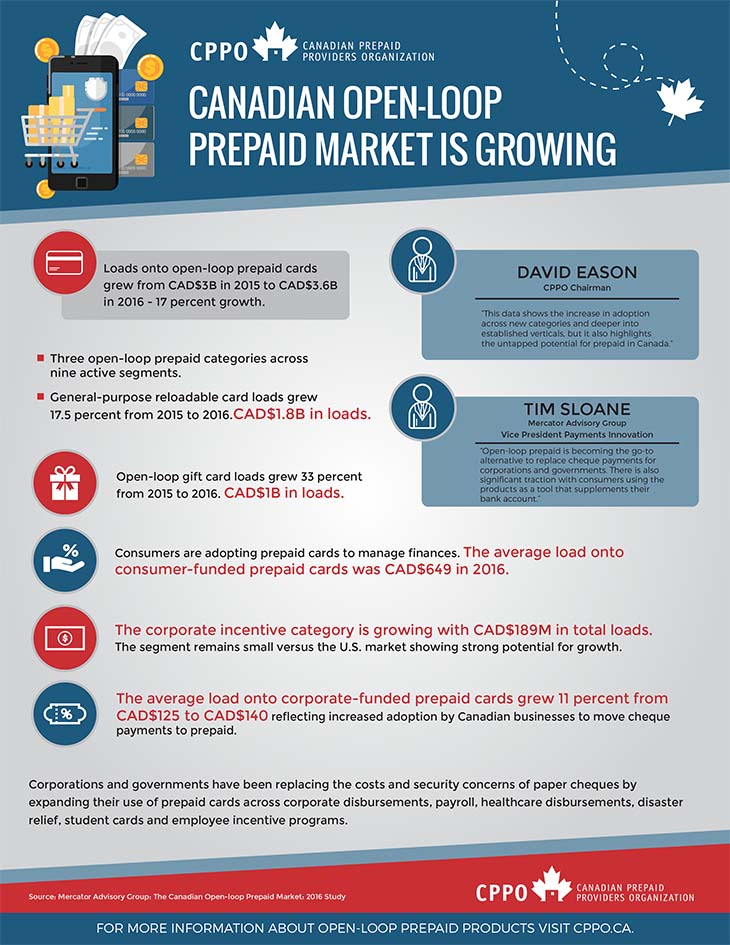

The Canadian Prepaid Providers Organization (CPPO) released its second annual benchmark study, entitled Canadian Open-Loop Prepaid Market: 2016, that shows 17 percent growth of the open-loop prepaid card market in Canada between 2015 and 2016. Growth in all nine active segments of consumer-, corporate- and government-funded prepaid cards drove the market to CAD$3.6 billion in total value loaded onto cards – revealing that Canadians are embracing prepaid payments tools at the same trajectory as most other major economies.

The Canadian open-loop prepaid market has experienced healthy growth in both total transactions and expansion into new segments. The CPPO study revealed that Canadians loaded CAD$1.8 billion on general-purpose reloadable cards in 2016 as a payment tool to replace cash and checks and supplement bank accounts for a highly banked population.

The Canadian corporate incentive market reached CAD$189 million in open-loop prepaid card loads in 2016, which is relatively small versus the US$90 billion non-cash incentive market in the U.S, showing strong growth potential. Corporations and governments are replacing the costs and security concerns of paper checks by expanding their use of prepaid cards across corporate disbursements, payroll, healthcare disbursements, disaster relief and student cards. The average load onto corporate-funded prepaid cards grew 11 percent.

The U.S. open-loop prepaid market is expected to reach nearly US$353 billion by 2020, and while the Canadian prepaid industry is still in its infancy, it’s ripe with opportunity. For instance, Canada’s largest province, Ontario, has a CAD$51.8 billion financial services sector and a CAD$30.5 billion information technology sector. Ontario is part of the second largest information technology cluster in North America and it is a leader in mobile payments. Canada’s close proximity to the U.S., language and cultural commonalities and strong test market attributes makes it a great market to launch new products or expand current portfolios.

For more information about the Canadian open-loop prepaid market, access the Canadian Open-Loop Prepaid Market: 2016 study and infographic.