Can a distributed finance solution be implemented on an island? Consider a commodity exchange interested in deploying smart contracts. Since the contracts must be tightly coupled to the products the exchange controls, what advantage does a distributed infrastructure deliver? Primarily it adds complexity and risk in return for a distributed environment that is of little use. If my startup company wants to issue shares using smart contracts, I need to select a platform and write the smart contract. People interested in buying shares now need to have the proper funds associated with the blockchain running that smart contract and they need to trust the smart contract is safe and reliable, and they need to trust the company they are buying the stock from since there is no organization validating that the company is real. So we have not only eliminated the need for centralized trust, we have spread trust out across multiple participants that are in themselves very difficult to properly validate.

These are problems similar to those associated with blockchains. There are use cases where a blockchain makes perfect sense but not every situation is aligned with the benefits and drawbacks of a blockchain. There are those that argue a blockchain delivers trust unassociated with a central organization, but that’s simply not true. Each blockchain, including Bitcoin, has a management team that decides what changes will be made. This decision gets harder and harder to make the more use cases execute on top of the platform and as the platform is more broadly deployed. This suggests that a private blockchain may often be most appropriate, but this means participants must once again trust other participating entities.

All of this hasn’t even touched on the trust that needs to be associated with the smart contract itself, and written in a Turing Complete software development environment, such as used on Ethereum. This means that the smart contract can do almost anything, it’s similar to writing software in the language C. So how is the code validated? By whom? By the unvetted company offering you shares? Again, there are likely use cases that make perfect sense for this technology platform but I doubt those use cases will prove to be as broad as currently claimed:

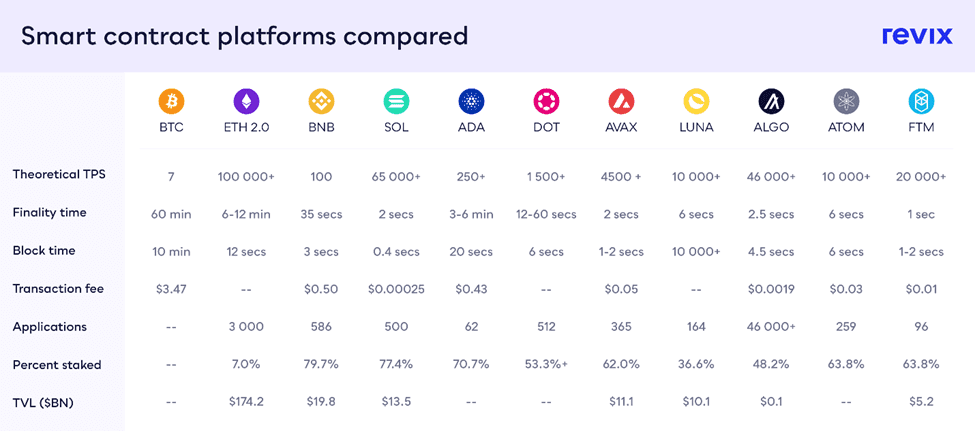

“Even though Ethereum is the world’s most popular smart contract platform, many have pointed out flaws in its armour. Several of these flaws include poor transaction speeds as a result of congestion, high fees, as well as significant power usage. While the Ethereum 2 upgrade is set to tackle these issues, many Ethereum competitors have arrived on the scene to solve these issues and steal Ethereum’s market dominance.

Who are Ethereum’s competitors?

Blockchains are constantly evolving and improving as each new blockchain tries to solve the problems of the other. This has started a race to see which blockchain can emerge victorious as the “Ethereum Killer”. Blockchains that are trying to do just that are Solana, Binance, Cardano, Terra and Polkadot, amongst others. Let’s have a look at some of these competitors and what they have to offer.

Overview by Tim Sloane, VP, Payments Innovation at Mercator Advisory Group