Fiserv announced that they have completed their 500th financial institution implementation to the Zelle network. Here’s some background on that milestone:

Fiserv, Inc. (NASDAQ: FISV), a leading global provider of financial services technology solutions, announced today that Alabama-based CB&S Bank has become the 500th financial institution to go live on the Zelle Network® via Fiserv.

As the list of banks and credit unions enabling person-to-person (P2P) payment capabilities with Turnkey Service for Zelle continues to grow, those financial institutions are also finding a path to real-time payments processing, one of the fastest-moving developments in the financial industry.

“We’ve put a lot of work into helping financial institutions get ahead of the proliferation of real-time payments,” said Matthew Wilcox, president, Digital Payments and Data Aggregation at Fiserv. “Our NOW® gateway, the connection point for real-time delivery, comes with every Zelle installation. It provides the foundation for real-time money movement and enables a number of other Fiserv payment applications including TransferNow®, our account-to-account (A2A) solution.”

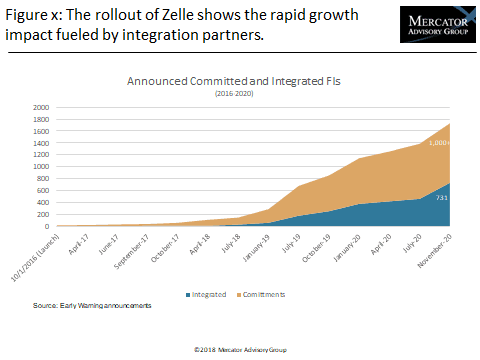

In early November, Early Warning, the operator of the Zelle network, announced that they had over 730 live banks and credit unions on their platform, meaning that most are using Fiserv to complete their integrations.

One of the metrics I track is the growth of reported commitments and implementations to Zelle. I think it may be an indication of how other faster and real time networks may be adopted in the U.S. Here’s a graph that tracks that progression:

Overview by Sarah Grotta, Director, Merchant Services at Mercator Advisory Group