This tale—which reeks of fiction but is entirely true—requires a bit of setup. Five years ago, in another phase of my professional life, I was a pipeline inspection specialist, which is a sanitized description of what I actually did. I was a pig tracker—someone who tromps around, often in the dead of night, and tracks the movement of diagnostic tools (that is, pigs) through petroleum pipelines.

(You see, once those tools are put in the swim of oil, they’re 6 to 12 feet underground and no longer observable. Someone on the surface, using a geophone and an electronic receiver, must verify that the tools keep moving down the line. This involves driving secondary and tertiary roads, parking for long stretches at places where the pipeline route crosses those roads, recording the passage of the tool, and calculating the speed of travel, the time to the next crossing, the time to the next pumping station, the time to the terminus, etc. Time, speed, and distance, baby.)

So, five years ago…

I was in Portage, Wisconsin, gassing up my vehicle for 12 hours on the night shift (midnight to noon). I ran my credit card through the reader at the pump, chose my product, and filled my tank. Did I want a receipt? You bet I did. That was the key to eventual reimbursement.

When the receipt came up, I looked it over. The final amount came to two dollars more than I’d pumped into my tank. I looked further: There was a candy bar listed on the receipt. I hadn’t bought one. The receipt showed a charge to Mastercard. I’d used American Express.

Inside the attached convenience store I went. Here’s the spirit of the ensuing conversation with the night manager, reconstructed from my contemporaneous Facebook post:

Me: “What the what?” (You know, along with a brief explanation of the receipt I was holding out to him.)

Mr. Night Manager, after some digging into the system: “Well, yeah, the fella in here before you grabbed the candy bar, authorized $30 on the pump, and never got his gas.”

Me: “Well, can you refund his transaction and charge me for the fuel I pumped?”

Mr. Night Manager: “Well, I can’t do that because I’ll lose money on the candy bar.”

Me: “Well, I feel awfully bad about taking this fuel, but it’s already in the tank, and I’m not about to siphon it out.”

Mr. Night Manager: “Well, I can charge you the amount and wait for this guy to come back when he realizes he never got his fuel. Your receipt just won’t show that you got gas.”

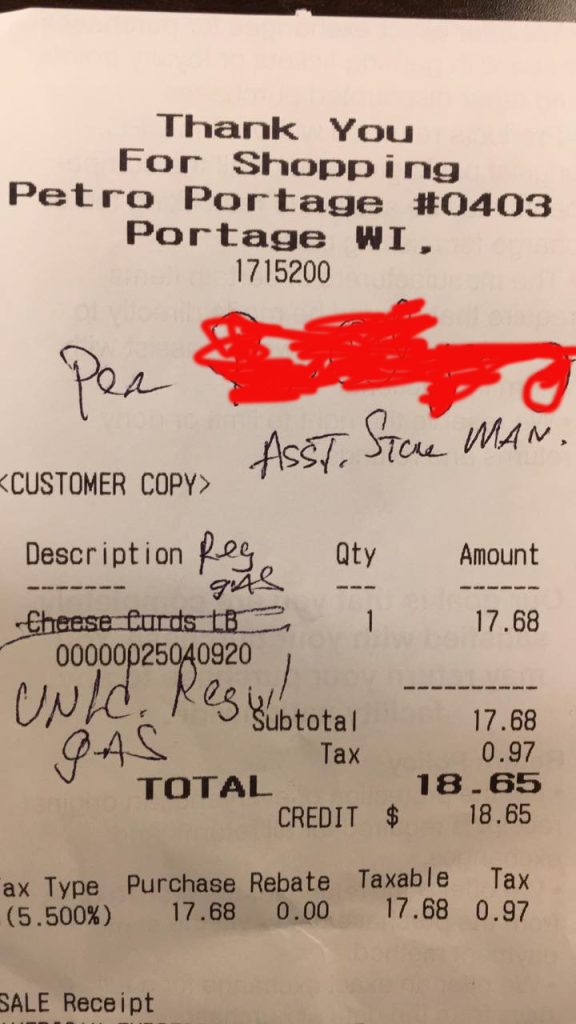

Me: “Well, the accountants at my shop won’t go for that. Can you sign the receipt and indicate what the purchase was for?”

Mr. Night Manager: “Well, I suppose I can do that.”

Me: “Also, do you show an authorization on my card on that pump? I don’t want to be the next sucker.”

Mr. Night Manager: “No, you’re good.”

All we needed now was a proxy product to ring up my sale. And this is how I came to possess a receipt for my expense report that shows I bought one pound of cheese curds, which, interestingly enough, came to the same amount—in December 2018, in Portage, Wisconsin—as a little more than eight gallons of fuel.

***

Five years on, as someone whose professional life hinges on thinking about the flow of money rather than the flow of oil, I have questions:

- Was there a better way to handle matters for the poor guy who ended up buying my tank of gas? If he never went back for his fuel, that ended up being the most consequential candy bar of his life.

- Would I be interested in a different payment method now? I doubt it. Those pipeline runs were expensive—with flights and hotels and car rentals and gas and food and supplies, they would easily come to several thousand dollars. All paid on a personal credit card (hello, rewards!) and all reimbursed by my then-employer.

- What is the state of the gasoline-and-cheese-curd market today? I paid about $2.33 a gallon that night in Portage. The current price for regular unleaded at the same store is $2.77 a gallon. That’s an 18.9% increase. On the other hand, the price of a pound of cheese curds has been stable: $17.98 for a pound, just 30 cents (1.7%) more than I paid in 2018, according to the store employee with whom I talked.

Either which way, living and eating and fueling up are expensive propositions. Even more so if you authorize $30 on your card and someone else swoops in and uses most of it.