World-leading biometrics company, Fingerprint Cards AB (Fingerprints™) announces its Biometric Software Platform for payments, named FPC-BEP, targeting payment cards, wearables and USB dongles. The platform has been tailored to optimize the performance of its small and power-efficient biometric sensors for payments, which include the FPC1300-series and T-Shape™ module. Fingerprints can now offer card and device makers a complete hardware and software solution to secure biometric authentication and maximize the user experience.

As part of the Biometric Software Platform, Fingerprints has developed a new in-house algorithm, adapting its proven mobile algorithm, which verifies billions of ‘touches’ per day, to the specific needs of payment cards and payment devices. Extensive internal tests using a 1300-series sensor show impressive biometric performance and best-in-class robustness with <2% FRR* @ 1/20,000 FAR**, and the fastest matching time available on the market.

“Biometric performance can only be optimized when you consider the whole package; hardware and software working in harmony,” comments Pontus Jägemalm, Chief Technology Officer at Fingerprints. “Our technology is used billions of times every day, and now we have poured our long and unrivaled experience from the mobile world into this software platform to maximize the performance in low-power and low-computing-power payment environments.”

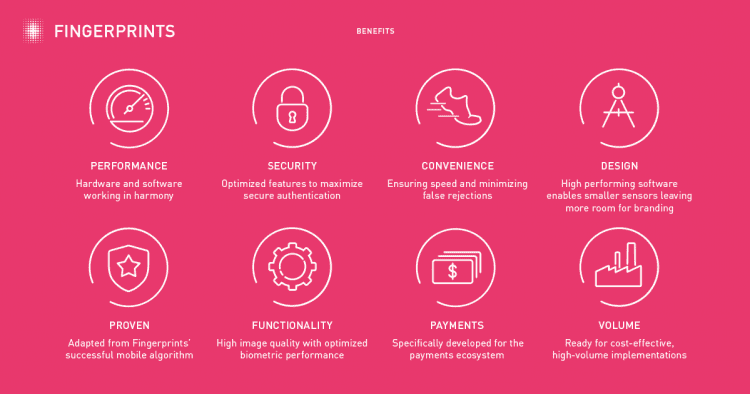

Biometric features & benefits

The complete software solution has been designed to maximize the payment transaction speed, user convenience and security. Optimized image capture with high image quality is central to this, which sees Fingerprints’ technology actively adapt to various use cases and conditions, both indoors and outdoors.

Other advanced features of the platform include:

- OneTouch® – the sensor is always ready to go, whenever it is needed, letting users make fast transactions as it never needs to boot up

- QuickTouch® – captures and verifies an image of your fingerprint in less than 0.3 second, to quickly confirm a secure biometric payment

- EvoTouch™ – with every touch, the intelligent algorithm learns something new and adapts to the user’s changing conditions

- 360Touch® – don’t worry about what angle you touch the sensor during enrollment or everyday use, the right fingerprint will be recognized no matter its orientation

- SafeTouch® – a collection of functions designed to maximize the security, making sure the sensor always knows it’s you

The software platform can either comprise a 3rd party biometric algorithm or Fingerprints’ own newly developed algorithm, enabling vendors to benefit from a holistic, seamless solution from one provider.

The platform is commercially available and will undergo certifications with payment authorities as part of Fingerprints’ ongoing collaboration with stakeholders throughout the payments ecosystem.

For more information on Fingerprints’ vision for the future of biometric payments and its existing solution please visit Fingerprints’ website.