1. Added security

Almost one-third of consumers and business owners agree that new technology will lead to safer payments with 31% of business owners admitting they feel safer using new payment tech, as it means they have less cash on their premises.

“To the consumer, the main demands of any payment process are that it needs to be simple, multi-channel (laptop, phone, tablet, etc.) fast, and yet secure. It is therefore up to the payment industry to determine how new technology can help meet the needs and demands of consumers and business customers.” says Howard Berg, SVP of Banking and Payment at Gemalto.

2. Extra consumers

With the growth of app-based payments via services like Apple Pay, it seems natural that customers will one day do away with passwords, cards and PINs altogether – helping to ease payment use and eliminate identity theft.

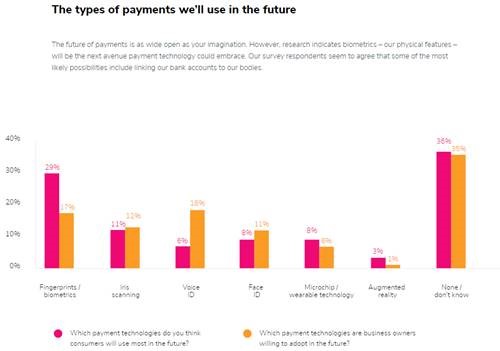

Unlocking your smart device with touch ID will one day become synonymous with making direct fingerprint payments. Laura Rettie, personal finance expert at money.co.uk says “there have already been trials of linking biometrics to pay for goods so we can’t be far off rolling out a system that links our finances to our physical features.”

3. Increased efficiency

According to our research, cards aren’t going anywhere fast. In the short-term it’s set to continue to grow as our choice way to pay. But how much longer will we be using plastic for?

Whilst the number of card transactions will reach 47 million by 2020, the average spend per card transaction will decrease to £24.91 (down from £33.12 in 2017) hinting at an increase in other payment methods that alleviate the hassle of our current payment methods.

4. Environmentally friendly

While only 6% of Brits would embrace new payment methods solely in order to cut down plastic use, the environmental benefits a cashless society would be transparent.

“Shopping online these days is so easy with ways to store your card details so you don’t have to dig them out each time you want to pay for something. It’s only a matter of years before we won’t need to carry wallets.” says Laura Rettie, personal finance expert at money.co.uk

5. Keep up with competitors

“Whilst a cashless society is on the horizon, the study highlights how Brits are still wary of being completely cashless, as many businesses still rely on cash as their main payment method. Those who adopt new payment methods such as fingerprint scanning and voice ID will surely surpass future competition.” says Guy Moreve, Chief Marketing Officer at Paymentsense.

Image 1. Screen shot from Paymentsense’s Future of Payments report.

Guy Moreve, Chief Marketing Officer at Paymentsense, says:

“As a society, it’s clear that new payment methods will evolve as consumer demands shift towards improved security and ease of use when making a transaction. Our survey highlights not only what advances Brits want to see in payment technology, but how businesses will need to adapt to these changing consumer demands.

Whilst a cashless society is on the horizon, the study highlights how Brits are still wary of being completely cashless, as many businesses still rely on cash as their main payment method. Those who adopt new payment methods such as fingerprint scanning and voice ID will surely surpass future competition.”

The full report can be found at https://www.paymentsense.com/uk/future-of-payments/