One of the biggest hurdles in the adoption of mobile payments is consumer comfort. That is to say, in order for consumers to adopt digital payments there has to be a level of trust, familiarity, and acceptance of digital payments that will entice consumers to use digital methods over older, more “engrained” methods. In fact, one of the biggest barriers to digital payments has always been a perception that the “current method works just fine” or “I see no need to switch”.

Well, things are changing. We’ve all read the stories of digital payment successes in place like Kenya and China. Alas, in economies that have had card based systems in place, adoption of digital – phone based – payments has been slower to gain popularity.

With all this in mind, I was very interested to read a commentary in Forbes about the adoption of P2P payments in Canada. In this piece, Canada Embraces Digital Payments, With Some Behind-The-Scenes Help, by Alan Zeichick from Oracle, he points to the rapid rise of one P2P solution, Interac e-Transfer.

Person-to-person (P2P) payments are one of the fastest-growing segments of business for Interac. Its P2P service, called Interac e-Transfer, saw 371.4 million transactions in 2018, representing a 54% increase over 2017. The amount of money involved is significant, too: CAN$132.8 billion in 2018, a 45% increase over 2017.

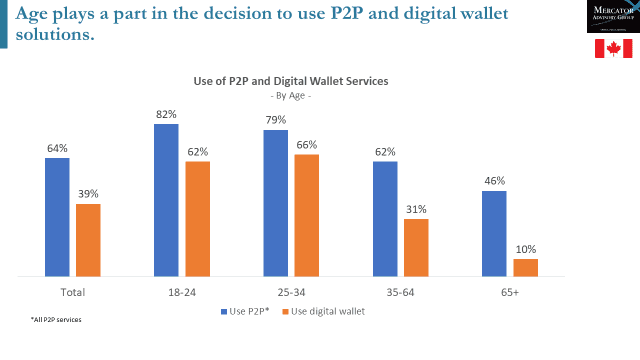

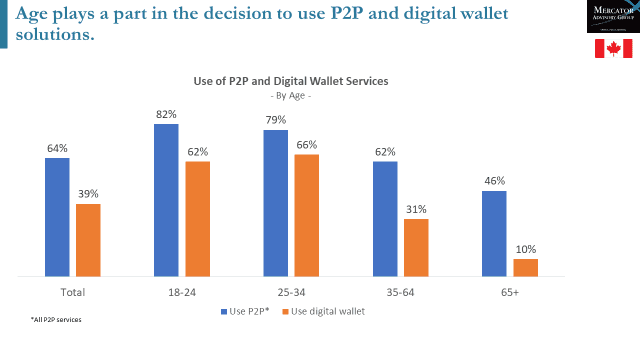

This are some compelling numbers and, as usual, I turned to Mercator’s North American PaymentsInsights data to get a better understanding of these numbers. The first thing I wanted to explore was how the numbers in the Fortune article play out in terms of actual people who use P2P services and how that compares with the use of digital wallets.

While the numbers presented by Mr. Zeichick are meaningful, I wanted to examine all P2P services, not just Interac e-Transfer. Nearly, two-thirds of consumers are currently using a P2P service. These data clearly show that P2P payments are becoming mainstream, not something used by a select group of payment nuts. Digital wallets are less used by Canadians, but the usage numbers among the younger adults show real promise for broader adoption.

As consumers become more comfortable with digital payments, however, true mainstream usage requires that merchants boost their end of the bargain and accept these payment methods. To steal a hackneyed quote Field of Dream “If you build it, they will come.” In other words, if you don’t have the acceptance of new payment methods (the “build it” part), then digital payments will not get used.

Overview by Peter Reville, Director, Primary Research Services at Mercator Advisory Group