The ACH Network saw a remarkable year in 2019 as the annual growth rate reached a 12-year high.

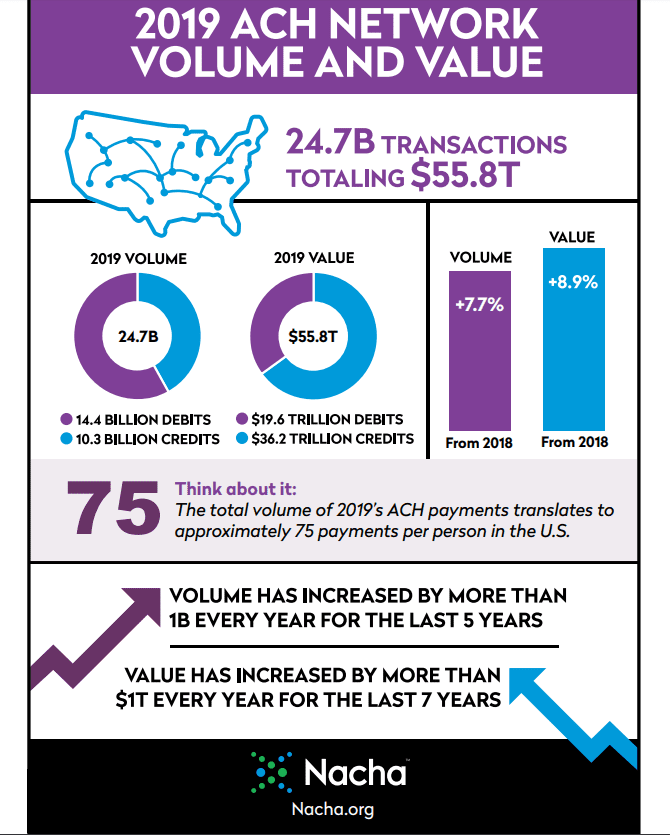

There were 24.7 billion payments on the ACH Network, an increase of 7.7% over 2018. The value of those payments was $55.8 trillion, up nearly 9% from 2018.

It was the seventh consecutive year in which ACH Network value increased by more than $1 trillion, and the fifth straight year to notch a volume gain of more than 1 billion payments.

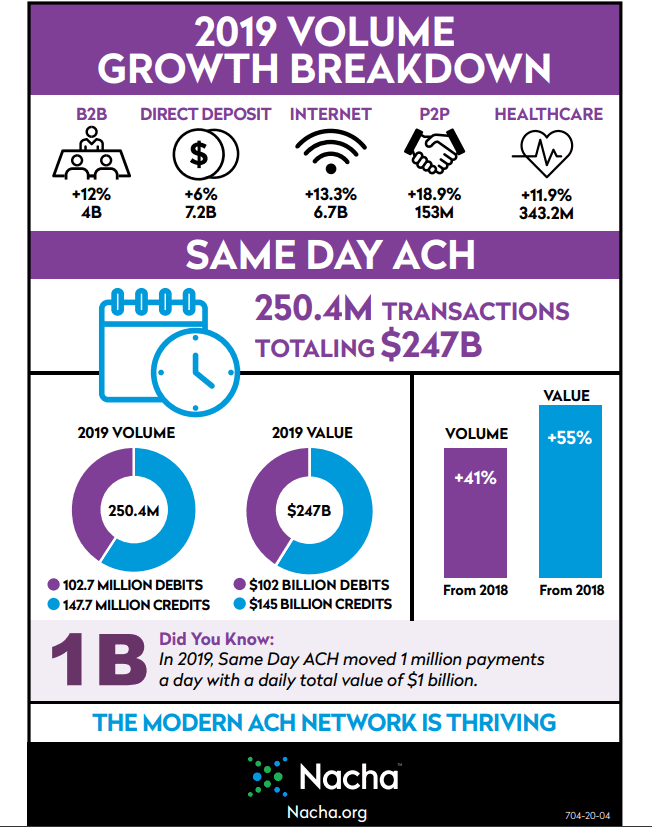

Business-to-business (B2B) payments continued to be a solid growth area for the ACH Network, increasing 12% last year to 4 billion payments. Direct Deposit of payroll and other payments to consumers was up 6% to 7.2 billion payments, while internet payments rose more than 13% to 6.7 billion.

“These outstanding results continue to show that the modern ACH Network plays a vital role in the nation’s payments system,” said Nacha President and CEO Jane Larimer.

Same Day ACH continued its impressive rise, finishing the year with a record 250.4 million Same Day ACH payments with a total value of $247 billion. Those are increases of 41% and 55% respectively.

“Same Day ACH is an important part of the modern ACH Network, and it is being embraced as the demand grows for faster payments,” said Larimer. “The next enhancement to Same Day ACH arrives in March, when the dollar limit per payment will quadruple to $100,000. This will make Same Day ACH even more attractive to consumers and to businesses of all sizes.”

Use of Same Day ACH for Direct Deposit soared 117% from 2018, with 77.6 million payments last year. Additionally, 2019 saw 51.7 million B2B Same Day ACH payments, up 47.5%.

About Nacha

Nacha is a nonprofit organization that convenes hundreds of diverse organizations to enhance and enable ACH payments and financial data exchange within the U.S. and across geographies. Through the development of rules, standards, governance, education, advocacy, and in support of innovation, Nacha’s efforts benefit all stakeholders. Nacha is the steward of the ACH Network, a payment system that universally connects all U.S. bank accounts and facilitates the movement of money and information. In 2019, 24.7 billion payments and nearly $56 trillion in value moved across the ACH Network. Nacha also leads groups focused on API standardization and B2B payment enablement. Visit nacha.org for more information, and connect with us on LinkedIn , Twitter , Facebook and YouTube .