An interesting report was released today at the Crunchbase site, this one summarizing a ten year period of fintech investment starting from 2010. Crunchbase is a mature startup from San Francisco dating back to 2007, and is one of the firms that provides a platform for finding business information about private and public companies. The report indicates that fintech unicorns tracked by the company have a collective value of $500 billion. In the report there is a brief summary of the COVID-19 impact on fintech investment.

‘The full economic impact of COVID-19 is still too early to tell but a long term recession or depression seems likely. “B2B companies will need to prepare for frozen sales pipeline for most of this year and longer sales cycles and shrinking budgets in 2021. B2C companies will need to adjust to reductions in consumer spending, greater emphasis on short term cash needs given spiking unemployment, and increased reluctance from consumers to switch financial service providers,” said Satya Patel founder of seed investor Homebrew. “The hardest hit fintech businesses will be lending businesses that have large outstanding loan balances and that will have to deal with lots of uncertain credit risk. In general, an increasing emphasis on unit economics over growth, will put some companies in a very difficult fundraising position.”

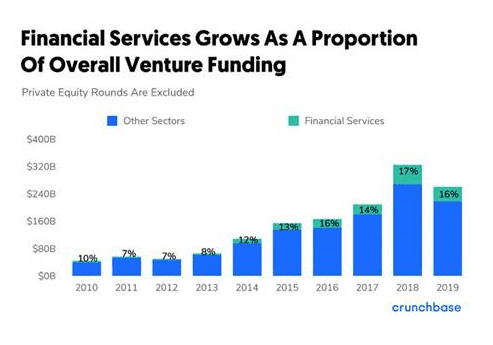

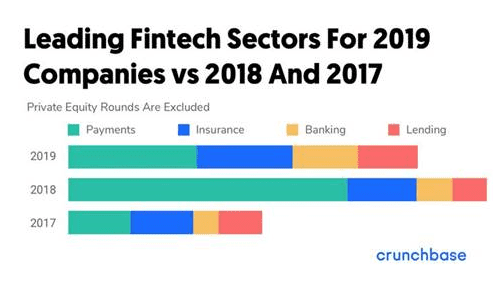

As we have been covering now for a few years, the real jump in VC startup funding began accelerating around 2014, with financial services representing a growing portion of these funding rounds. The investments revolve around some major categories, including payments, banking, insurance and lending.

The payments sector represents the largest portion of these investment from 2017-2019. Of course these are global numbers, so market numbers include startups such as India’s One97 and Sweden’s Klarna, among others.

We suggest a browse through the report for those interested in how fintech has grown, where and perhaps future directions (now under a COVID-19 cloud but likely to reshape at some level by year-end).

“Fintech is driving new business models as opposed to being a business model in its own right,” according to Ryan Gilbert at Propel Venture Partners. “More and more categories will include fintech elements in order to

be competitive. For e-commerce trends, or new ways of servicing verticals– for example cosmetics, hairdresser and barbershop verticals–these booking systems are providing full operating systems for large parts of the economy”…

“More focus will be placed on B2B products and services that shore up the foundation for B2C fintech startups and traditional financial services companies. Instead of emphasizing growth, companies will try to operate more securely and efficiently. Key areas include compliance, servicing and identity.”

Satya Patel, Homebrew

Overview provided by Steve Murphy, Director, Commercial & Enterprise Payments Advisory Group at Mercator Advisory Group.