If, by some chance, you have been reading some of my recent posts, you will know that many of them have been wondering about the fate of the bank branch. My hypothesis is that during the “lockdown” caused by the pandemic, many of the people that used to frequent branches will have found other ways to transact (ATMs or digitally), and some of those will not go back to branches with any regularity.

To carry the hypothesis to its next logical step, depending on the severity of the reduced traffic, banks may rethink their branch strategy and begin closing those branches. I’m am not going to say that I know what the magnitude of this will be or what the long term affect will be.

All that said, I came across some data that gives some perspective to the issue at hand. J.D. Power published their most recent wave of the J.D. Power Financial Services COVIC-19 Pulse SurveySM. This survey queries American adults on many issues related to the affect the COVID-19 pandemic has had on their financial lives and shows the deep seated concerns that Americans have because of the economic shake-up the pandemic has created. This survey was conducted during the last three days of May this year.

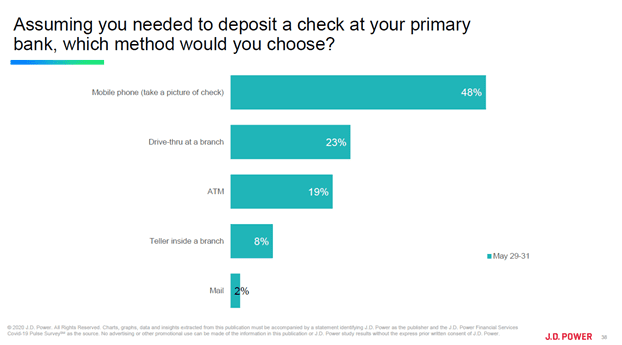

There was one slide from the report that was of particular interest to me. They asked consumers how they would deposit a check.

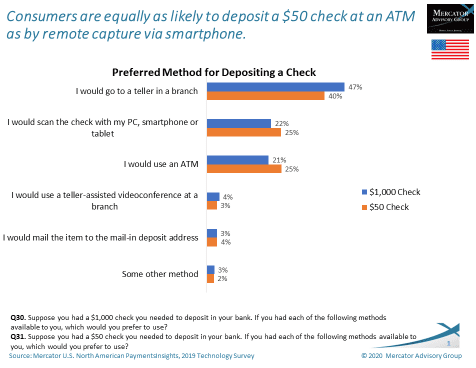

As the graph clearly demonstrates less than 1 in 10 would visit a teller to deposit a check. In fact, the use of a teller is only more popular than mailing a check in for deposit. Without context, however, the importance of this chart is lost on many people. Finding context, however, was not hard. In our recently published North American PaymentsInsights ATM Report, North American PaymentsInsights, U.S – ATMs: No Fee for Me we asked two similar questions of consumers in Late November and early December of 2019. Specifically we asked consumers how they would deposit a $1,000 and $50 check.

These pre-COVID survey results paint a very different picture from the J.D. Power results. Before the pandemic, Americans were most likely to choose to deposit a check, of either value, at a teller in a branch.

These differences are staggering.

Being a bit of a research purist, I understand the issues related to comparing results from different surveys. There is context effect, sampling difference and more. However, I am compelled to show these results because of the sheer size of the differences. We are talking orders of magnitude difference (five times to six times) here. This is something that cannot be ignored.

As mentioned earlier, I have written several posts for PaymentsJournal on why this is happening and I don’t feel the need to go into those reasons here in great depth. Suffice to say, we are seeing a significant shift in retail banking and the numbers prove that out.

Overview provided by Peter Reville, Director, Primary Research Services at Mercator Advisory Group.