PSCU, the nation’s premier payments credit union service organization, has updated its weekly transaction analysis from its Owner credit union members on a same-store basis to identify the impact of COVID-19 on consumer spending and shopping trends.

To provide relevant updates on market performance, experts from PSCU’s Advisors Plus and Data & Analytics teams today released year-over-year weekly performance data trends. In this week’s installment, PSCU compares the 24th week of the year (the week ending June 14, 2020 compared to the week ending June 16, 2019).

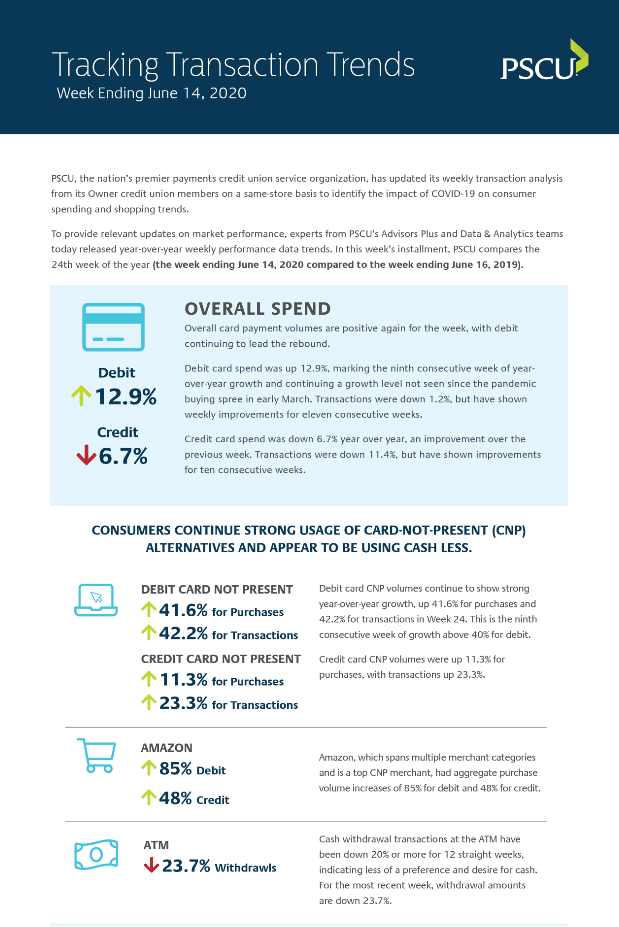

- Overall card payment volumes are positive again for the week, with debit continuing to lead the rebound.

- Debit card spend was up 12.9%, marking the ninth consecutive week of year-over-year growth and continuing a growth level not seen since the pandemic buying spree in early March. Transactions were down 1.2%, but have shown weekly improvements for 11 consecutive weeks.

- Credit card spend was down 6.7% year over year, an improvement over the previous week. Transactions were down 11.4%, but have shown improvements for 10 consecutive weeks.

- Consumers continue strong usage of card-not-present (CNP) alternatives and appear to be using less cash.

- Debit card CNP volumes continue to show strong year-over-year growth, up 41.6% for purchases and 42.2% for transactions in Week 24. This is the ninth consecutive week of growth above 40% for debit.

- Credit card CNP volumes were up 11.3% for purchases, with transactions up 23.3%.

- Amazon, which spans multiple merchant categories and is a top CNP merchant, had aggregate purchase volume increases of 85% for debit and 48% for credit.

- Cash withdrawal transactions at the ATM have been down 20% or more for 12 straight weeks, indicating less of a preference and desire for cash. For the most recent week, withdrawal amounts are down 23.7%.

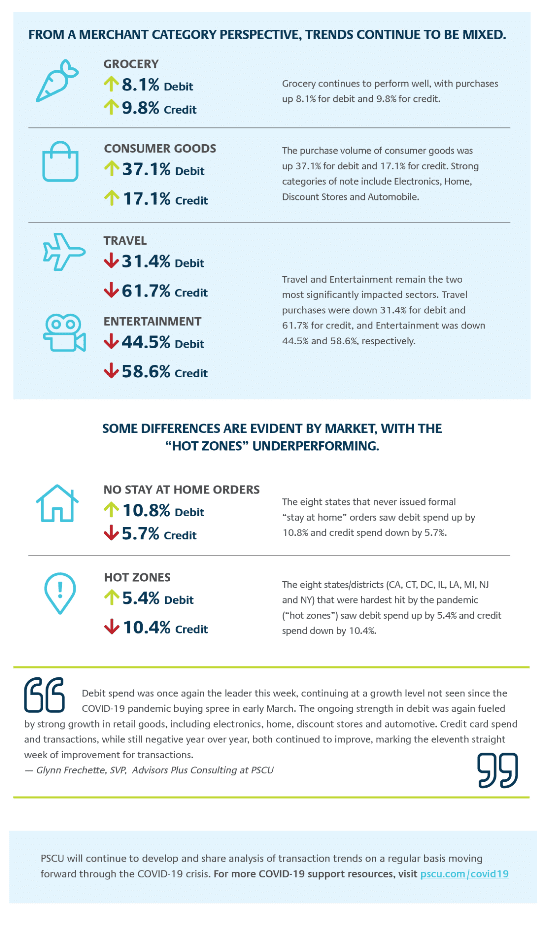

- From a merchant category perspective, trends continue to be mixed.

- Grocery continues to perform well, with purchases up 8.1% for debit and 9.8% for credit.

- The purchase volume of consumer goods was up 37.1% for debit and 17.1% for credit. Strong categories of note include Electronics, Home, Discount Stores and Automobile.

- Travel and Entertainment remain the two most significantly impacted sectors. Travel purchases were down 31.4% for debit and 61.7% for credit, and Entertainment was down 44.5% and 58.6%, respectively.

- Some differences are evident by market, with the “hot zones” underperforming.

- Overall U.S. spend was up 13% for debit and down 6.6% for credit.

- The eight states that never issued formal “stay at home” orders saw debit spend up by 10.8% and credit spend down by 5.7%.

- The eight states/districts (CA, CT, DC, IL, LA, MI, NJ and NY) that were hardest hit by the pandemic (“hot zones”) saw debit spend up by 5.4% and credit spend down by 10.4%.

“Debit spend was once again the leader this week, continuing at a growth level not seen since the COVID-19 pandemic buying spree in early March,” said Glynn Frechette, SVP, Advisors Plus at PSCU. “The ongoing strength in debit was again fueled by strong growth in retail goods, including electronics, home, discount stores and automotive. Credit card spend and transactions, while still negative year over year, both continued to improve, marking the 11th straight week of improvement for transactions.”

PSCU will continue to develop and share analysis of transaction trends on a regular basis throughout the COVID-19 crisis.