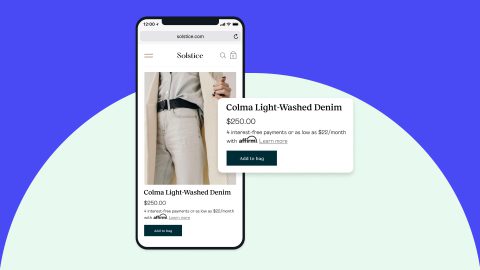

Affirm, a leader in the Buy Now Pay Later (BNPL) payments space, has announced innovative technology that enables merchants to display targeted and curated payments solutions based on the customer profile and basket contents. The new product, called Adaptive Checkout, uses proprietary algorithms to display the payment options and terms available to a specific shopper based on what they are buying. Shoppers are only shown options that they are already approved for, and a side-by-side offering allows the shopper to easily compare the payment options and amounts to select the best choice.

“Adaptive Checkout provides consumers with even more choice and flexibility at checkout,” said Geoff Kott, chief revenue officer at Affirm. “Providing an optimized set of payment options for consumers to choose from has resulted in our highest-converting checkout solution for merchants.”

BNPL sales will continue to expand as innovative tools like this help merchants to apply the right BNPL offering at the right time to optimize their sales lift from this alternative payments platform.

Photo Credit: Business Wire.

Overview by Don Apgar, Director, Merchant Services Advisory Practice at Mercator Advisory Group