As an avid Apple Pay user, I read with interest a recent Quartz article on the worldwide growth of this digital wallet. According to the article, Apple Pay is on pace to account for 10% of all global card transactions; Apple Pay currently accounts for 5% of global card transactions and that number will double by 2025.

While it may not seem like Apple Pay will monopolize card transactions any time soon, 5% is a big number considering the number of players in the space and many ways to pay. In the last three months of 2019, Apple’s service unit Apple Pay created $12.7 billion in revenue, which is a 17% increase from the same period a year earlier.

How does Apple make money from Apple Pay card transactions? Apple makes its money by taking a little piece of the transaction fee applied to every card transaction. Given the number of card transactions that happen every day, this “little” piece they take clearly adds up to some real revenue for Apple.

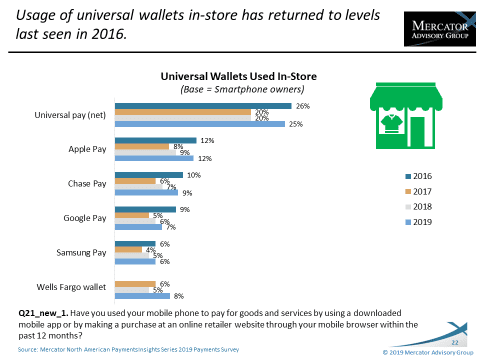

Our PaymentsInsights data shows growth of the use of universal wallets like Apple Pay and Chase Pay as more consumers get used to the idea of a mobile wallet and, equally important, the increase in merchant acceptance.

As the article points out, Apple has clear advantages over some of its universal wallet competitors:

There’s no shortage of slick, feature-rich payment apps out there, but Apple Pay has several advantages. The app is pre-installed on iPhones, and Apple has tight control over the device’s NFC technology that’s used for contactless payments. That’s why Apple Pay is the only iPhone mobile wallet that can make NFC transactions. (Alipay and WeChat Pay, the enormously popular Chinese payment apps, use QR-codes. The optical codes are read through a phone’s camera and aren’t controlled by Apple.)

Alas, there are some potential hiccups along the way to payments domination. First of all, Android phones are the dominant market leader globally – and I don’t think you’ll see Apple Pay on an Android phone any time soon, for obvious reasons.

Further, the article does highlight some of the regulatory issues that Apple is up against in the EU as regulators have shown concerns about Apple playing nice with the competition. We will have to see where that all nets out.

Digital universal wallets are here to stay. What was once a nice to have feature is starting to become mainstream. Some will argue that it’s about time since Apple Pay launched in 2014.

Card payments have a lot of moving parts. In order to get transactions to run through a phone, the system needs help from the payment networks, issuing and acquiring banks, POS manufacturers and, most importantly, consumers. Given all this, it’s a wonder we’ve gotten this far.

Overview by Peter Reville, Director, Primary Research Services at Mercator Advisory Group