COVID-19 has more businesses than ever thinking about how to create, deliver, and optimize the customer experience. In a recent global survey by Econsultancy, marketing and IT professionals at companies with revenue below $200 million identified “optimizing the customer experience” and “creating compelling content for digital experiences” as their leading goal for the year. Across large and small companies, “optimizing the customer experience” was the first choice for B2B and the second choice for B2C organizations, and “creating compelling content for digital experiences” was No. 2 for B2B and No. 3 for B2C, respectively.

It’s a laudable goal, but it also can’t be implemented overnight. Digital maturity – an organization’s ability to deliver seamless digital brand experiences – is a holistic process that spans every channel and continuously evolves. In my experience working with companies across the U.S. FSI market, I’ve found it’s the businesses with strong data-driven strategies, relevant, connected customer experiences, and fluid mobile experiences that have the best foundation for digital maturity, and the companies that devote themselves to developing and advancing holistic strategies that maintain it.

That said, it’s never too late to develop a strategy. My advice to the many businesses that now find themselves pursuing digital maturity is this: Take a phased approach. Make sure your digital customer experience efforts can crawl before you make them walk, and make sure they’re walking regularly before you make them run.

Crawl: Assess your company’s present digital maturity and focus on improving specific pillars

Adobe’s CXM Playbook identifies six key pillars of digital maturity: A Digital-First mindset; Data and Insights; Scalable Content; Optimized Personalization; Customer Journey Management; and Pervasive Commerce. Most companies are more ahead in some pillars than others, which makes an honest self-assessment a critical first step. A gap identified is a gap that can be filled.

Equally crucial: Recognizing that you cannot fill all gaps at once. Perhaps your company already has a Digital-First mindset, with leaders across every department recognizing that digital tools are a competitive advantage, but much of your customer data remains inaccessible to everyone outside of whichever department collected it. In that case you should focus on Data and Insights, breaking down siloes between verticals so that each facet of the company is drawing from the same pool of data when developing new business strategies or choosing when and how to approach customers.

Other pillars require predecessors to serve as their foundation. To cite a real-world example, financial services incumbents have been worried about digital startups for years – in Adobe and Econsultancy’s 2020 Digital Trends Report: Financial Services in Focus, almost one in four financial services companies named fintechs and insurtechs as their overriding concern, and it’s why more than four in 10 said they were prioritizing customer journey management.

The problem? Most don’t have the Data (and Insights), people (with digital-first mindsets), or infrastructure needed to accommodate Optimized Personalization, and therefore Customer Journey Management. And that’s probably why almost half of financial services respondents in our survey (49 percent) indicated they were either not very advanced or outright immature when it came to customer experience maturity. Optimizing Customer Journey Management requires not only committing to a long-term customer experience strategy but investing in the resources necessary to support every pillar behind it.

It’s natural to want to improve your company’s shortcomings, but like a teenager attending progressively tougher classes before reaching university and the working world, you’re probably better off focusing on specific aspects of your digital experience strategy, building it one pillar at a time, rather than trying to reach digital maturity based on a single lesson.

Walk: Establish a governance framework and steering committee

Once companies have a strategy in place, they should establish a governance framework and a steering committee. No digital maturity strategy will amount to anything without people to lead it and a means for them to achieve it.

A governance framework lets everyone on your committee know who gets to make decisions about every step of your digital strategy. It ensures that strategy is aligned with your overall business. And it keeps you out of trouble in a world full of complex and varied legal restrictions on the use of customer data.

The steering committee is your boots on the ground, the ones who will make your digital maturity strategy happen. I recommend lining up the front-line workers you’ll need early in the process, enlisting an executive champion, and making sure all relevant executives – including the CMO, CIO, and CFO – support your new digital strategy. Start communicating your vision early and often to all of the people who will use, benefit from, or be impacted by it.

As with the Crawl stage, it’s a good idea to take a phased approach instead of trying to do everything at once. I find that clients who concentrate on developing and pursuing a few clear goals – no more than five – for each pillar or pillars that they’re focusing on have the best results. For example, if your chosen pillar is Pervasive Commerce – ensuring your company has embedded shoppable experiences across every channel – your goal might be driving a two-point lift in conversion for web pages used in outbound marketing campaigns.

For each goal, you should also identify a few performance indicators – between three and five – that you can measure. If you started with three goals, you might end up with 15 indicators. Pick the three indicators that matter most for your business. These are your KPIs. Use them to guide your strategy.

If you find the above steps working for you, follow a similar path when you reach the execution stage. Going back to the Pervasive Commerce example, you can start by deploying some basic features for a subset of your websites, and then expand the rollout to include additional platforms and features.

Run: Regularly re-evaluate your strategy and support its growth

Digital maturity is not a set-it-and-forget it process. Nor should it be, given the dynamic nature of websites, apps, and screens, based on changing preferences, design, content, and campaigns. Like a fitness regimen, it requires dedication and tenacity, a systematic and repeated process of setting a measurable goal, benchmarking your current state against that goal, developing the steps required to reach your goal, defining what successfully meeting your goal looks like, evaluating your incremental progress toward the goal, and refining your approach as you go.

And as with a fitness regimen, when you stick to that practice with honesty and diligence, you’ll find it becomes second nature. Eventually you won’t be able to imagine doing things any other way. Reaching your goals will push you to evolve, improve, and strive for bigger goals. With exercise, that bigger goal could be joining a triathlon; with digital maturity, it could be extending your transformation beyond customer service and throughout the enterprise.

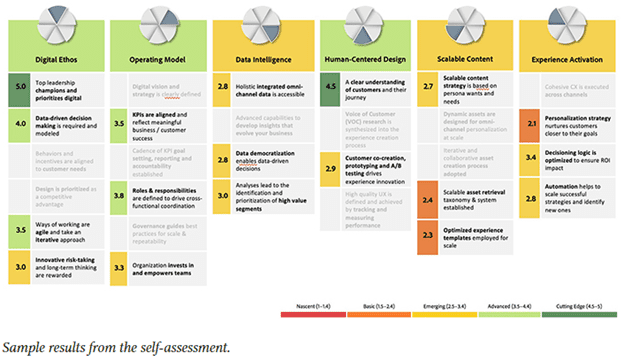

At Adobe, we’ve converted our CXM Playbook into an ongoing self-assessment model that, much like a personal trainer, helps businesses diagnose their current state. Our most progressive customers – many of them leaders in their respective industries including financial services, retail, healthcare, insurance, automotive, media and publishing, and B2B – take this assessment on a quarterly basis. They understand that to improve, they need to repeatedly gauge their progress, identify where they’re succeeding, and where they can do better.

As a Runner – both literal and figurative – the most important lesson you’ll learn is that you’re never done. There will always be new goals to achieve, new features to adopt, and new customers to convert into loyal advocates for your brand. The good news is that the tools exist to help your company innovate quickly and grow at a pace that makes sense for your business model. As you use them to evolve your operations, your customers’ needs will evolve too, and you’ll be able to invent new ways to exceed their expectations as well as your own.