A headline this week suggests that consumers are throwing away their debit cards in preference for credit cards. Here’s the core point of the story:

Since 2013, the percentage of households that use debit cards has dropped from 74 percent to 58 percent, in favor of alternative payment methods, such as credit cards and online/mobile banking. Almost a third more households pay with credit now compared to five years ago.

New Jersey, Connecticut and Hawaii are among the states that have seen the sharpest decreases in debit card usage. South Carolina and North Dakota have seen the least change

What this report appears to be looking at is two points in time. If you take the opportunity to look at the growth of debit card ownership and use, and compare that with ownership and use of credit cards over time, you will find that both ebb and flow. As the economy constricts or credit becomes less available, consumers use debit more. And the reverse is true also. Lately, consumers are using credit and making the most of rewards available, particularly as credit rewards become richer and due to the revenue constraints on debit, rewards are declining there.

The article also suggests that banking apps are causing consumers to spend less on debit cards. Unless there is a payment app within a digital banking app that allows a consumer to by-pass debit and use a direct checking account debit, then there will be little impact on debit cards.

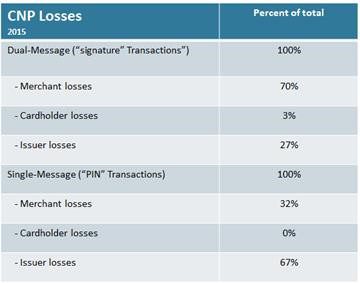

There was also an assertion that debit cards are less-safe when used to make ecommerce purchases. It is true that fraud on a debit card impacting a checking account can be problematic, it is rare that a consumer end up paying for that loss.

Below is a chart from the Federal Reserve Board of Governors showing who actually pays for card-not- present fraud on debit cards:

Overview by Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group