2018 has seen the once futuristic biometric smartcard go from talk to trial. From the U.S.A. to France, Lebanon to Japan, momentum is gathering as the benefits of fingerprint sensors look set to revolutionize contactless payments worldwide.

But in a sea of trial updates and product launches, it can be difficult to get to grips with what exactly a biometric smartcard is, how it works and, crucially, when we all might get one from our banks.

Spot the difference

A biometric smartcard may not look too different from your everyday payment card but looks can be deceiving.

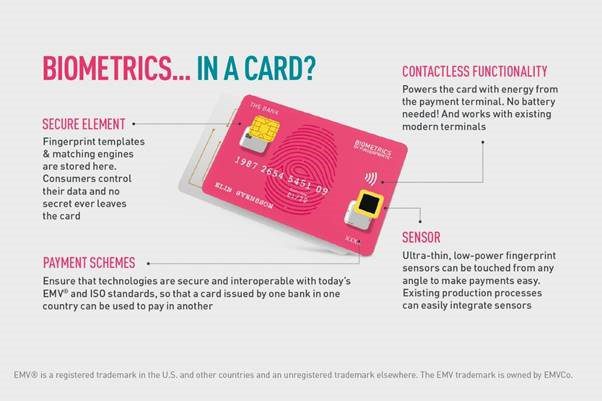

Enabling you to say goodbye to the inconvenience of signatures and PINs, this advanced payment card integrates an ultra-thin fingerprint sensor which becomes the strong authentication method for payments.

This brings extra security without impacting the current UX and speed of contactless. What’s more, contactless payment caps can be removed, queues cut short and consumer trust increased – all with a single touch!

And it’s not just the payment data that is kept safe, as the user’s biometric data is treated with the same importance to ensure privacy. Once the user has enrolled, the biometric templates* are stored, and all matching is done, in the card’s secure element (SE). When a payment needs authenticating, the sensor captures the user’s fingerprint which is then compared to the stored template using an advanced algorithm. The payment request is then accepted or rejected accordingly all in under a second.

So, where’s the catch?

Despite what you might think, these cards are now ready to be integrated seamlessly into our everyday lives.

All of the R&D expertise gained refining smartphone sensors has been used to develop these power efficient, flexible, robust and thin sensors for payment cards, wearables and dongles. Importantly, they no longer need a battery as they can be powered completely by the field generated by the POS terminal itself.

Industry requirements have been considered too. Developed in-line with global EMV® and ISO card payment standards, the tech makes use of existing manufacturing processes and demands little change from payment stakeholders.

All of this means they are ready to scale and require little additional effort and financial investment from vendors. As we reach scale, the price of these cards will fall, and everyone can start to reap the benefits of the biometric payment card.

Make space in your wallet…

Our sensors have come a long way since first launched seven years ago in smartphones and the lessons we’ve learnt since then have allowed us to adapt our technology to keep up with the ever-evolving payments landscape.

What is exciting is that trials are now in progress around the globe because consumers want this technology; they are keen to use contactless more but many are concerned about fraud. Biometrics satisfies the demand for increased security and flexibility.

But they won’t be the only ones to feel the effects. Banks can strengthen their reputation and increase revenues by driving increased card usage, increasing trust and reducing fraud levels. Merchants will embrace the technology as they will benefit from increased spending and higher revenues as in-store wait time is cut short, consumers have less time to second-guess purchases and spending is limitless thanks stronger security removing the need for the cumbersome payment cap.

To learn more about how we are mobilizing biometrics for payment cards, download our new eBook here.

EMV® is a registered trademark in the U.S. and other countries and an unregistered trademark elsewhere. The EMV trademark is owned by EMVCo, LLC.

* A biometric template is a mathematical representation of the fingerprint