Commercial fleets have used Radio Frequency Identification (RFID) tags to authorize fueling transactions for many years now. Usually, these tags are affixed to a windshield, connected into the on-board diagnostic connector, or attached to the fuel nozzle, and allow drivers to quickly turn on the pumps with their company credentials. Using RFID technology in fleet helps to eliminate cards, expedite fueling transactions, and obtain monitoring and control over fleet spending. Now, this technology is coming to consumers with added mobile text payment functionality.

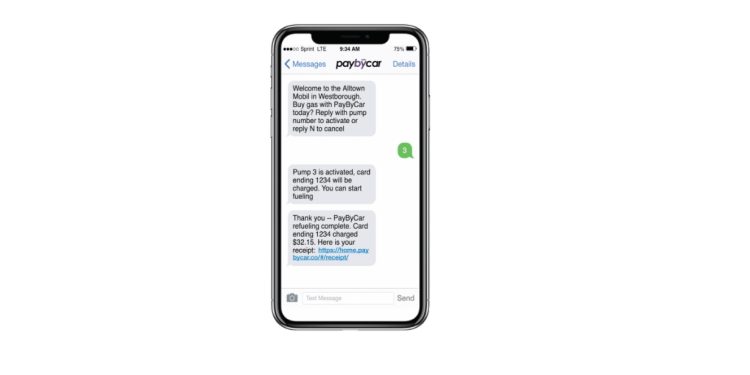

Boston-based mobile payments startup PayByCar™ is partnering with the Massachusetts Department of Transportation and the E-ZPass Group to offer mobile fuel payments. For consumers that drive into the 27 participating Alltown gas stations, PayByCar uses the E-ZPass toll transponder to send a welcome text message to your phone, turn on the pump, and allow fueling. After the transaction, a digital receipt can be sent to your e-mail address. For those without an E-ZPass transponder, PayByCar will send you a free non-toll RFID sticker to affix to your car.

“PayByCar helps solve that problem by offering an easy-to-use, app-less, text-based platform where the customer’s only requirement is to respond with their pump number when prompted by a PayByCar text notification.”

PayByCar eliminates the need for a card to be used at the pump, promises to speed up the overall transaction, and with digital receipts, allows for easy monitoring of the payment. Mercator analyst Ben Danner expects many of the benefits from commercial fleet usage of this technology will cross over to consumers, saying: “I always prefer to get a paper receipt after my fueling transaction, but the lifecycle of the receipt goes like this – I view it for about one second after printing, stash it out of the way, and eventually find it crumpled into a deep pocket of my vehicle when I go to clean.”

Looking from another perspective, Mercator analyst Shreyas Shaktikumar remarked on the partnership through the lens of IoT payments: “With a promised 50% reduction in average transaction time, this partnership between PayByCar and the MA DoT is the latest step in payments innovation through Internet of Things technology… The EZ pass transponder has previously been exclusively utilized for tolls, with this partnership marking a significant departure from ‘business-as-usual’. The idea of a universal transponder that would transform the way consumers pay while in their vehicles, from drive-through facilities to parking, provides the payment industry with exciting possibilities to leverage the mobility of vehicles.”

Mercator Advisory Group’s comprehensive research and analysis of IoT payments had predicted the rise of vehicle-based payments, in both IoT Payments: Taxonomy Driven Market Size and Company Rankings and Internet of Things Technology and Consumer Devices: Machine Triggered Payments Continue Growth in U.S. Households. Meanwhile, for those looking to try out the new tech in the Massachusetts area, Alltown and PayByCar are offering participants a 30 cents per gallon discount on up to a maximum of 20 gallons of fuel per visits for 5 visits from December 13, 2021 to February 10, 2022.

Overview Written in Collaboration by Ben Danner and Shreyas Shaktikumar, Research Analysts at Mercator Advisory Group