SALT LAKE CITY, March 20, 2019 /PRNewswire/ — Galileo, the trusted technology partner for fintechs, financial institutions and investment firms worldwide, today announced significant company growth and an expanded portfolio of payments and cash management solutions that increases business opportunities for its clients.

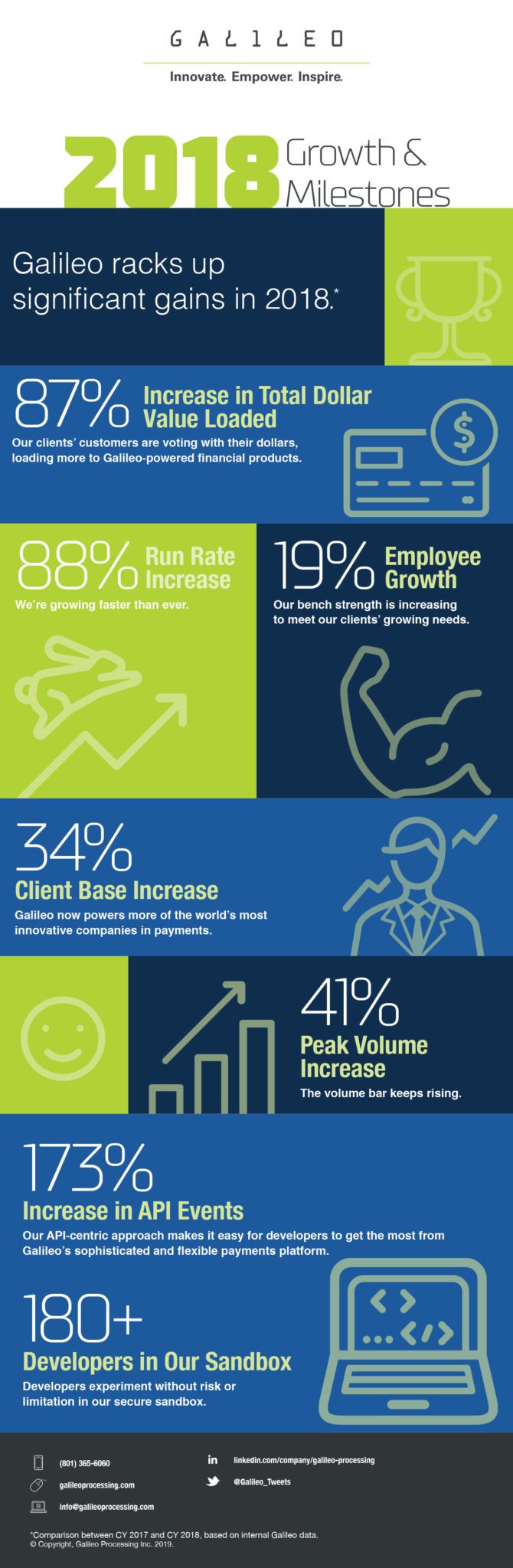

Galileo’s client base grew 34 percent and the company’s number of employees increased 19 percent in 2018 compared to the previous year. The company added well-known fintech clients that offer digital banking and investing services, including Aspiration, TransferWise, Robinhood, IDT and Skrill/Paysafe. In 2018, the total dollar value loaded to the nearly 100 million accounts on Galileo’s platform increased 87 percent over the prior year. Galileo also experienced an 88 percent increase in its annual run rate and a 41 percent increase in peak volume.

“We attribute our outstanding growth in 2018 to Galileo’s technology and expertise that make it easy for companies to build without limitations to disrupt and improve how people manage their money and their finances,” said Clay Wilkes, Galileo CEO. “As fintech’s tech, we empower the world’s financial transactions and improve how money moves, grows and enables access for people around the globe.”

As part of the company’s dedication to inspiring and empowering fintech and payments innovation, Galileo expanded many of its technology capabilities in 2018, including:

- Enhancing its robust suite of open APIs, giving developers the flexibility to create custom, innovative financial products, while delivering exceptional customer experiences that are wholly their own.

- Enriching its sandbox, where developers can test and iterate their payments solutions in a secure environment and without risk. During the past year, more than 180 developers used Galileo’s sandbox and Galileo’s API events increased 173 percent.

- Launching the Galileo Securities Solution, enabling bank-like financial products with high-yield, FDIC-insured returns that can become consumers’ primary vehicle for everyday purchasing and payment as well as saving.

- Expanding the power of artificial intelligence to minimize clients’ card-based fraud losses. In 2018, Galileo enriched its AI-enhanced fraud protection capabilities, using deep learning to generate even greater accuracy in fraud detection.

- Meeting clients’ needs for expanded payments solutions to generate additional revenue streams, including DDA with overdraft, virtual commercial and consumer cards, and commercial and consumer credit.

Click here to access the infographic.

About Galileo

Galileo is the company behind the technology that powers the most innovative fintech companies, financial institutions and investment firms in North America, the UK and Europe. Our advanced processing platform handles nearly 1 million financial transactions every day and offers industry-leading APIs and complete back-office support, so our clients can stay focused on delivering great value and a superior experience to their customers. Galileo is based in Salt Lake City, Utah.