Mobile payments are gradually squeezing out cash and credit cards.

And, with years to come, the preference for online payments on mobile devices is only expected to grow.

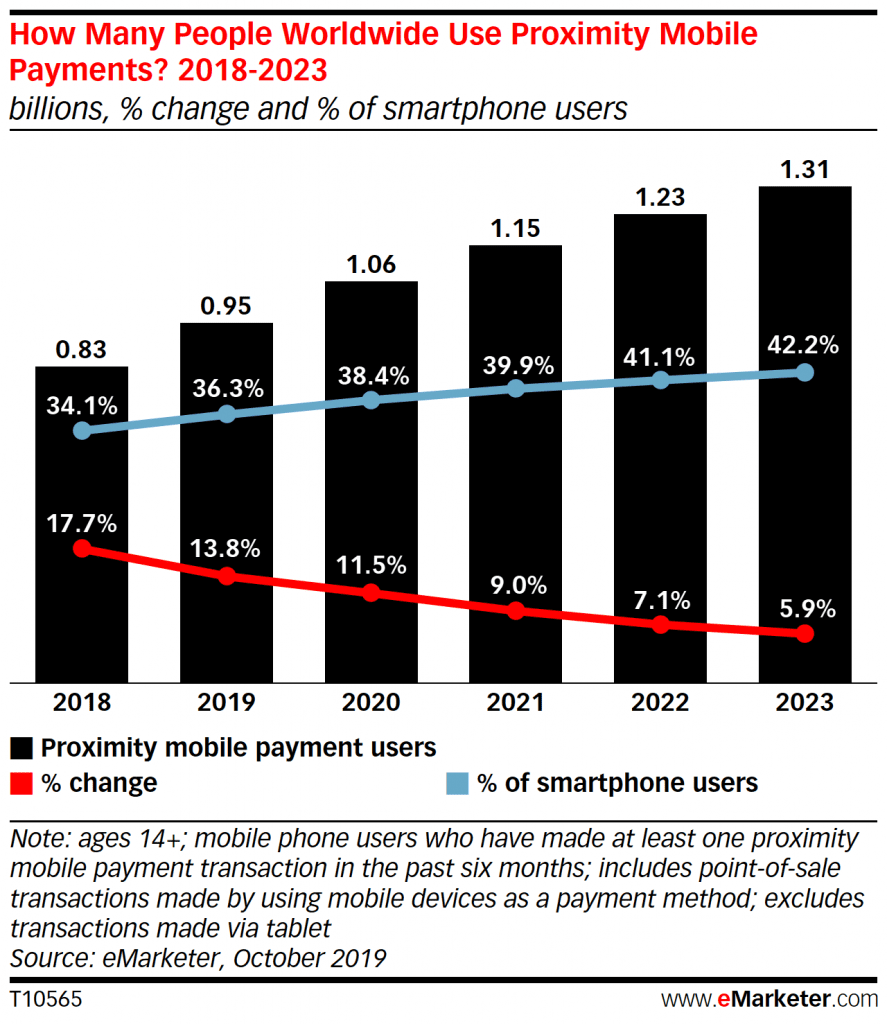

According to the report by eMarketer, by 2023, 42.2% of people worldwide will be using mobile payments, and only approximately 6% will use cash:

Younger generations support this shift, as both millennials and Gen Z-ers speak in favor of online payments on mobile devices.

Yet, today, there is still a certain distrust in mobile payments. And the security of mobile payments remains the main concern. Reportedly, 38% of consumers say that mobile payments are somewhat protected, while the other 38% think they are poorly protected.

Are Mobile Payment Security Concerns Far-Fetched?

Unfortunately, no.

Mobile payment methods are still vulnerable, although companies invest millions of dollars into improving the security of online payments on mobile devices.

One of the latest data security breaches happened last year with DoorDash, an on-demand prepared food delivery service from San-Francisco. Breached data included personal information and contact details from customers, and order history, and mobile payment details.

As a result, this data breach cost affected 4.9 merchants and consumers.

Thus, as the probability of mobile payment security threats is still high, companies keep looking for technologies that will help mobile users be more confident to pay with their devices.

However, there are some things you can do today already to somewhat secure online payments on mobile devices.

Let’s take a look.

1. Two-Step Authentication

Also known as the 2FA method (two-factor authentication), this option is a good fit for those who make regular payments with mobile devices.

Two-step authentication is a confirmation method, which requires a customer to provide additional registered data in response when a customer makes payment.

Two-step authentication can include the following mechanisms:

- a customer receives a call on their phone to confirm the transaction

- a customer receives a text message with a code to proceed with the transaction

- a customer is required to provide biometric data like a fingerprint, voice or facial recognition

Two-step authentication is the most common method to secure online payments on mobile devices. It is used for mobile wallets as well as to secure the VoIP gateway used by ‘pay-as-you-go’ services.

Two-step authentication, however, is not a one-size-fits-all method.

It is important to implement those authentication steps that fit the transaction value, type of mobile device, and type of payments (new or regular).

Other than that, two-step authentication has proven to be one of the trustworthy methods to secure online payments on mobile devices.

2. Secure HTTPS Connection

In case your customers make purchases from mobile devices, you need to provide a secure connection to make these online payments safe.

But while securing the Wi-Fi connection is the task for your customers and their internet provides, you can also do your part to secure online payments through your website.

The method that has proven to be the most effective is switching to the HTTPS protocol.

How can it help secure online payments on mobile devices?

- Cutting the middleman. Any data shared between a mobile device and your server remains private, and no other party can get access to it.

- Better encryption. HTTPS uses Transport Layer Security – a cryptographic protocol that provides better communication security than its predecessor SSL, used in HTTP.

- Confident customers. Google warns its users about every website’s level of security. Today, HTTPS is no longer a choice, it’s a requirement from Google that impacts not only search results but your traffic and conversions as well.

Since half of the traffic today comes from mobile devices, e-commerce businesses and other companies, who deal with online payments, should consider improving the security of their websites.

3. Tokenization of Mobile Payments

Breaches of personal data are among the biggest mobile payment security concerns. And one of the novel methods to tackle this problem is mobile payment tokenization.

Tokenization digitizes a physical payment card, and, using tokens, turns it into several digital payment means.

This method can be helpful for online payment systems similar to Google Pay that digitize a physical credit card and encrypt the personal data that it holds using tokens.

How does it work exactly?

Tokenization is used to convert the primary account number (PAN) into tokens. When the user is ready to make the transaction through a mobile device, the token releases payment credentials to the network.

Before the transaction is complete, the Tokenization platform verifies the validity of the payment. Thus, tokenization adds an extra level of security to online payments on mobile devices.

Over to You

Although mobile payments today are more secure than they were in the past, there are still a lot of security concerns.

And while the technology is far from its perfect state, there are still some steps you can do to make online payments on mobile devices more secure. You can either turn to more traditional options like two-step authentication and the HTTPS protocol or try tokenization that provides more security to payment data.

Either way, the confidence and security of your customers when it comes to mobile payments depends largely on you.

Ryan is a passionate writer who likes sharing his thoughts and experiences with the readers. Currently, he works as a digital marketing specialis, you can check his website here. He likes everything related to traveling and new countries