Today’s post is based off of an interesting announcement that we picked up at Mastercard’s site, detailing a partnership with Envisible, a recent startup out of Michigan that provides traceability and supply chain visibility for global food systems.

The specific product mentioned is called Wholechain, which Envisible describes as a “blockchain based traceability solution built to enable trust, coordination, and transparency in fragmented supply chains.”

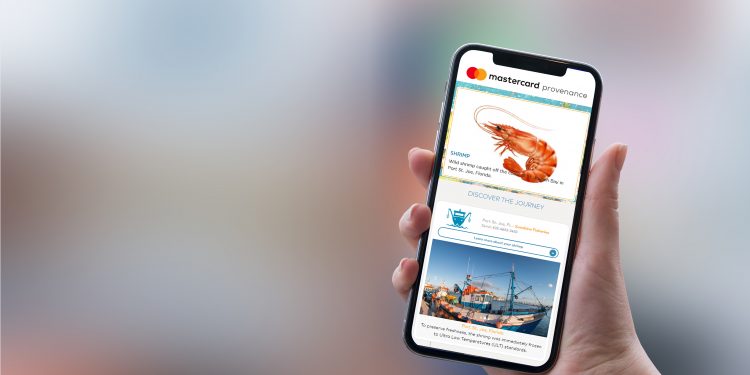

The product uses Mastercard Provenance, also a recently announced blockchain system for tracking and monitoring products through the production chain.

“Envisible’s Wholechain traceability system will be powered by Mastercard’s blockchain-based Provenance Solution and used by Topco Associates, LLC, a leading United States food cooperative, to help its member-owners’ supermarkets trace and highlight the origin of seafood. Topco is working with its member grocery chains, starting with Food City, to pilot the use of the technology to provide better line of sight into ethical sourcing and environmental compliance of the seafood selection sold at their stores. The first of several species to be tracked will be salmon, cod and shrimp.”

In a discussion with Deborah Barta, a Mastercard SVP for Innovation and Startup Engagement, we learned that the system is scalable and ready for prime time, unlike many of the blockchain-related pilots dotting the landscape which we track around various use cases, including trade finance and payments.

Barta indicated that by using a phone app, shoppers will be able to scan a QR code and receive details about the product’s origins and journey. The system can be integrated with multiple point solutions and other platforms to provide other potential value-add business services.

One example we discussed as a logical integration path is Mastercard Track, a trade management facilitation system now expanding services into payments and financing.

We also asked Mastercard’s Barta about the seemingly new business direction, which appears outside the traditional Mastercard distribution model centering on financial institutions. Indeed this is the case, with expectations for corporate clients across various segments.

In this case they are starting with the food industry.

“The sheer volume of global trade makes it difficult to track the journey and authenticity of food,” said Mark Kaplan, partner, Envisible. “We’re excited that Mastercard shares our vision and is driving consumer trust by bringing its significant expertise in using technology at scale with commercial-grade processing speeds, data flexibility and privacy, and security standards to an area that has previously been considerably opaque.”

There are bound to be more developments in the innovative new world of formerly card-centric networks, which have been branching out into broader payments and technology spaces as new capabilities enable a digital world.

Overview by Steve Murphy, Director, Commercial and Enterprise Payments Advisory Service at Mercator Advisory Group