Cyber security issues continue to plague consumers as the ubiquity of digital banking soars and becomes the entry point for a majority of U.S. banking customers. With the access to digital banking rising, a recent survey by Quantum Metric puts the onus on both banks and consumers to control the rising occurrences of digital security issues. Reza Zaheri reports further in Security InfoWatch:

“Quantum Metric’s recent retail banking survey reinforces the need for improved cybersecurity, finding that 31% of banking consumers have recently dealt with data security issues – either by having their account hacked, or their credentials were stolen.”

Alternative banking technologies, such as Person-to-Person (P2P) payments highlight the ease of which consumers have moved out of seemingly outdated payment methods such as utilizing paper currency or checks as well as utilizing traditional banking applications in order to easily move money between peers. The Quantum Metric survey indicates 72% of consumers make P2P payment to friends, family or potentially a small business. This results is similar to Mercator Advisory Group research which identified 77% of U.S. consumers utilizing a P2P app in similar fashion. This large result underscores the need for financial institutions, P2P apps and related organizations to clarify the risks and provide solutions, as Zaheri reports:

“While digital banking transactions can expose consumers to cyber risks, it’s a form of banking that isn’t going anywhere. To help users safely transition, financial institutions should educate customers on how to securely use digital banking platforms and encourage them to set up features such as multi-factor authentication, SMS or email alerts, and fraud monitoring to prevent suspicious online banking activity.”

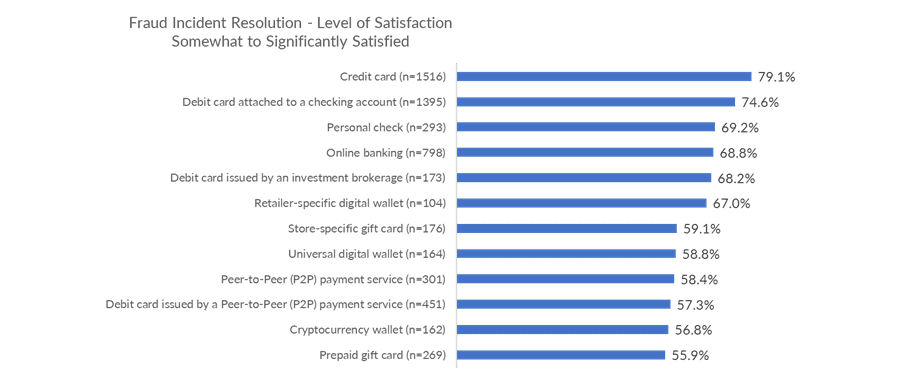

The educational aspect is a starting point to reduce fraud occurrences and maintain a healthy level of customer satisfaction, while acknowledging that fraud prevention requires buy-in from the consumer. Our Mercator P2P research identified varying levels of customer satisfaction related to satisfaction in resolving fraud incidents. In our research, there is room for improvement from all sectors of the industry with increasingly more room for improvement as solutions become more digital, such as P2P, digital wallets and cryptocurrency.

Source: Mercator Advisory Group, 2022

The article also points out easy to implement actions FI’s can take to push their customers to better secure data individually while establishing better corporate policies to enable a more secure overall platform:

“Cyber hygiene keeps accounts safe, but many Americans don’t practice it or don’t understand what it means. For example, nearly one in three (30%) of respondents who use a password only change it once or twice a year, with an additional 23% admitting to never changing their password.”

These actions create easy to follow procedures for customers to more frequently change passwords and protect their personal financial data and in return the push from the FI creates a higher level of customer satisfaction that their institutions are looking out for the wellbeing of each customers data and money.

Overview by Jordan Hirschfield, Director of the Prepaid Advisory Service at Mercator Advisory Group.