PORTLAND, Oregon and SAN FRANCISCO, May 1, 2018 – Nvoicepay, the leader in Payment Automation software for the enterprise, and Inspyrus, the leader in Invoice Automation and Dynamic Discounting software, today announced a joint technology partnership to deliver a unified solution for invoice and payment processing that dramatically increases process efficiency and reduces costs.

Many organizations have struggled to achieve high levels of invoice automation and many more grapple with high costs and processing inefficiencies associated with payments—the “last mile” of the invoice automation equation. The Nvoicepay and Inspyrus technology partnership aims to change this; together they bring to market the most complete (end-to-end) and comprehensive invoice automation and payment solution available today.

With over 500,000 suppliers in its network, Nvoicepay enables customers to pay 100 percent of invoices electronically, achieving over 75 percent cost savings versus issuing paper checks, while delivering control, visibility and traceability for each payment. The solution transforms the massive and expensive effort of paying suppliers into a simple automated solution by providing a single process for managing all payments.

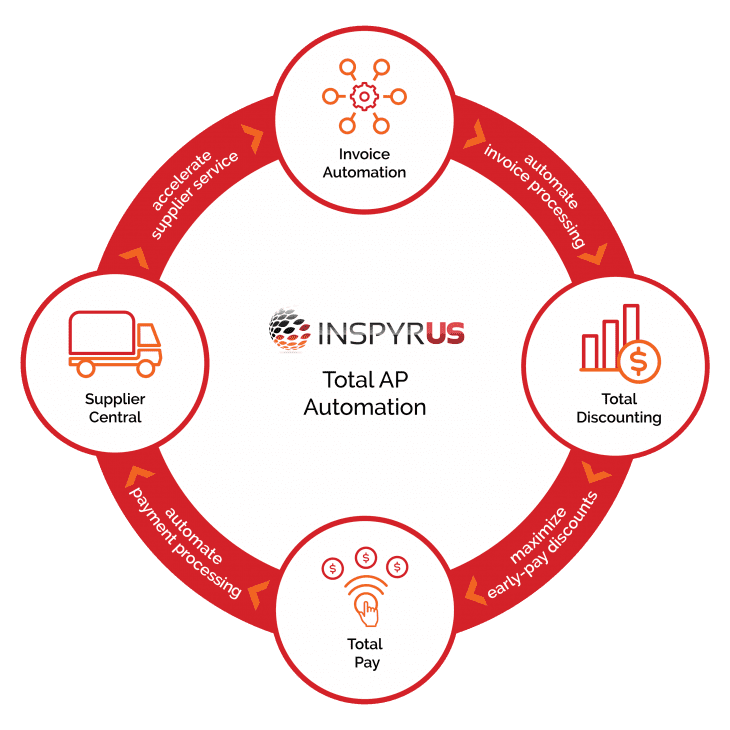

Inspyrus’ award-winning solution and its unique approach to invoice processing enables organizations to automate up to 90 percent of accounts payable (AP) operations with the potential to deliver up to 3 times the cost savings compared to legacy and competitive approaches, while also maximizing the capture of early pay discounts (with savings up to 2 percent of corporate spend).

Together, the two companies offer a unified, elegantly simple and automated solution called Inspyrus Total Pay, which transforms 100 percent of the manual effort managing multiple invoice payment methods (including checks) into touchless electronic payments. Inspyrus Total Pay powered by Nvoicepay delivers the following benefits:

Advanced Automation: Automatically pays 100 percent of invoices electronically using ACH, Card, electronic print check, iACH, and iWire. Automates payment approvals and provides easy real-time reconciliation.

Cost Savings: Delivers over $5 per payment in moving archaic paper-based payment processes to electronic payments.

Continuous Payment Program Support: Provides resources for driving continuous electronic payment adoption—ensuring the best customer results.

Trusted and Secure: Payments are guaranteed, bonded and insured. Clients can pay international suppliers across 170 countries in 140 currencies through the same simple process as domestic payments.

“We’re very excited to partner with Inspyrus. It’s a natural fit both from a technology and a culture perspective, given both companies’ strong technology innovation focus and commitment to challenge traditional AP conventions,” said Karla Friede, Chief Executive Officer and Co-Founder, Nvoicepay. “Inspyrus’ technology is impressive. Together we’re able to bring higher levels of automation to bear via a holistic invoice automation and payment solution.”

“Our partnership with Nvoicepay brings a new and exciting strategic dimension by adding a best-in-class Payment Automation solution to the Inspyrus portfolio,” said Nilay Banker, Founder and Chief Executive Officer, Inspyrus. “Companies continue to struggle managing multiple payment methods and processes—especially paper checks. Nvoicepay’s unique and comprehensive approach to payment processing goes well beyond bank and other fintech offerings by providing a simple, single, central point for automating the entire payment process, and ensuring supplier electronic payment adoption continuously runs at peak performance.”

“The Nvoicepay-Inspyrus technology partnership seems well positioned to capitalize on a growing opportunity as organizations seek to wring out costs and inefficiencies out of invoice processing through to the payment management process,” said Jimmy LeFever, Director, Research and Consulting, PayStream Advisors. “The final step in any payables process is invoice payment. The most efficient means to make payments—the ones that belong in a fully automated payables process—are commercial cards, followed by ACH payment (via an electronic payment platform). However, in our research, the most common payment method used today was the least efficient and most costly method—manual check payments.”

About Nvoicepay

Nvoicepay transforms the massive and expensive effort that goes into paying suppliers into a simple and automated solution. For over 2,500 customers, we optimize electronic invoice payments for enterprises with intuitive cloud-based software. In addition, Nvoicepay provides comprehensive supplier services through our Payment Command Center and the highest level of security in the industry. By automating all payments, Nvoicepay unlocks resources and immediately reduces accounts payable costs by 75 percent. Learn more at http://www.nvoicepay.com and follow us on Twitter at @Nvoicepay.com.

About Inspyrus

Inspyrus is a Silicon Valley Fintech Software-as-a-Service (SaaS) company that specializes in transforming Accounts Payable into a profit center. As an Oracle preferred solution partner for Accounts Payable automation, Inspyrus provides solutions for Invoice Automation, Dynamic Discounting, and Supplier Enablement. Supported by several patent-pending technologies, Inspyrus provides out-of-the-box, real-time integration with leading ERP systems including Oracle’s E-Business Suite, JD Edwards, PeopleSoft and ERP Cloud, as well as SAP and IBM. Our solutions are used by some of the most esteemed brands and leading-edge companies in the world, across various industries, ERP systems, and geographies—with environments ranging from 2,500 invoices/month to over 450,000 invoices/month, across 30+ countries and 18+ languages. To find out more visit: http://www.inspyrus.com.