PPS, formerly PrePay Solutions and subsidiary of Edenred, the everyday companion for people at work, today announces its partnership with Yolt, the smart money app, following the inaugural launch of its contactless debit Mastercard.

Following its first step into the payments space with Yolt Pay in 2019, the award winning fintech is now working with PPS on the launch of its first physical card.

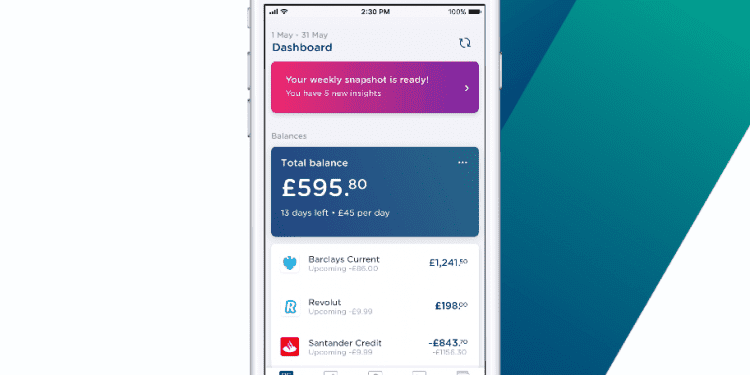

Thanks to PPS’ technology and licensing, Yolt’s product experience is enhanced, equipping customers with an e-money account linked to a PPS powered Mastercard debit card enabling the users to manage and spend money online and instore. Together with PPS, the Yolt app helps people to save on every single purchase with round ups and cashbacks on selected brands.

Born in 2017 out of a simple mission to give everyone the power to be smart with their money, over 1.5 million users have registered with the app to date. Yolt enables customers to bring together all of their accounts in one central place from the likes of American Express, Starling, Barclays and HSBC. By having all accounts in one central place, the app enables smart spending, budget tracking and financial goal setting.

Ray Brash, CEO of PPS, commented on the partnership:

“Following the recent launch of Yolt Pay, we’re delighted to support this exciting fintech in the next leg of its evolution, with its first ever card. We look forward to the future of our partnership supporting the company with a roadmap of enhancements and new functionalities.”

Pauline van Brakel, Chief Product Officer, Yolt, added:

“We’re incredibly proud of the progression of the Yolt app. Now, more than ever, is a time for people to be spending cautiously and saving where they can, preparing for any uncertainty that may lay ahead of us. We couldn’t have made this launch happen without the help of innovative partners such as PPS, who can improve our customer offering. In the future, we are excited about further enhancing our product by utilising PPS’ platform.”