While banks sag under the weight of regulations and supervision, the U.K.’s Financial Conduct Authority (FCA) has in multiple instances failed to properly regulate electronic money institutions (EMIs) according to this article in Bloomberg.

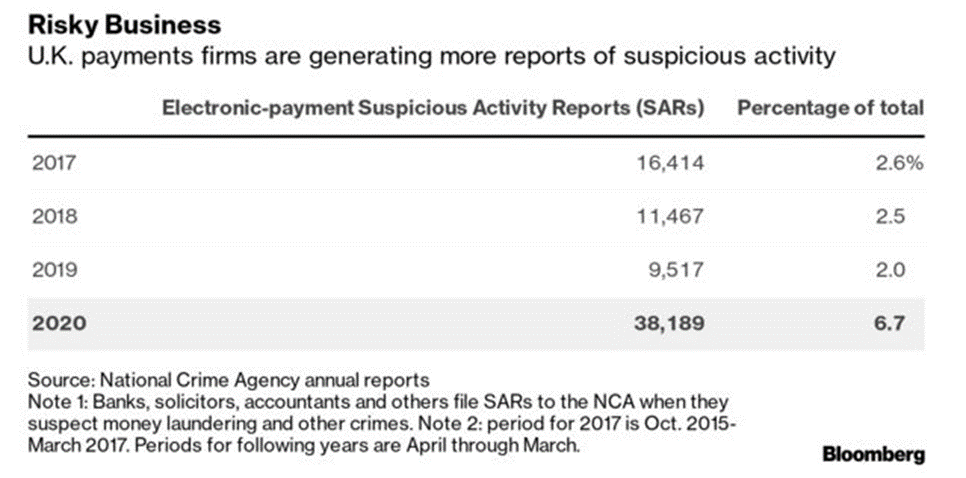

Despite obvious links to suspicious activity, the FCA has authorized companies to participate in money movement as EMI-approved agents. Once the EMI company is operating, the banks that are the source or destination of a money transfer perform their duty and file Suspicious Activity Reports (SARs), which have quadrupled since March 2020. Despite shady owners and a flurry of SARs against these EMI-approved companies, the FCA rarely takes action and the management of these EMI-approved companies haven’t been accused of any wrongdoing. Below is just one example from this well researched Bloomberg article:

“Along with the growth is the potential for greater risk-taking. The number of Suspicious Activity Reports, or SARs, linked to the electronic-payments sector quadrupled in the year through March 2020. A spokesman for the U.K.’s National Crime Agency said the surge in SARs—which firms and individuals are required to file when they’ve observed shady behavior—wasn’t unexpected given the expansion of the industry. The Bank of England has warned that the sector “could in the future present systemic risks.”

Few have embraced the business more than Moorwand’s former chief executive officer, Robert Courtneidge. Renowned for his payments expertise, Courtneidge, 57, has been a qualified solicitor since 1990.

By the mid-2010s, he was a consultant at U.S. law firm Locke Lord LLP, a colorful presence at fintech industry awards in London and beginning to take up EMI board roles. He also did some cryptocurrency consulting for Ruja Ignatova, a Bulgarian known as the Cryptoqueen, who was then promoting the OneCoin digital currency. U.S. prosecutors accused her of overseeing a $4-billion fraud. She never appeared in court to face the charges.

In 2015, Courtneidge became a director of AF Payments Ltd., a London-based firm that received its EMI license several years later. The company’s founder and CEO is fintech entrepreneur Guy Raymond El Khoury, but its only listed shareholder is a British Virgin Islands entity, filings show.

El Khoury previously ran FBME Card Services Ltd., a related company of FBME Bank Ltd., which was barred from the U.S. financial system after accusations that it had laundered funds for criminal organizations and paramilitary groups including Hezbollah. El Khoury said through his lawyer that he wasn’t responsible for wrongdoing at the card services company, which didn’t involve money laundering, but rather sought to end it. Neither El Khoury, AF Payments nor Courtneidge have been accused of any misconduct.

Courtneidge joined the board of CFS-ZIPP Ltd., another EMI, in 2016. He allegedly helped arrange a 1.5 million-pound loan from the company and its owner to a currency-trading firm promoted by a then-business partner, according to a U.K. legal action filed last year. That venture, SwissPro Asset Management AG, collapsed in 2019 with losses of more than 50 million pounds. A Swiss regulator said in a letter to creditors that the business “appears a Ponzi scheme.” Courtneidge, who left the CFS-ZIPP board that year, hasn’t been accused of wrongdoing.”

Overview by Tim Sloane, VP, Payments Innovation at Mercator Advisory Group