Since consumers started shopping online there has always been the struggle between getting the products and services they want and the security concerns inherent in providing PII and payments details. That said, the constantly increasing e-commerce sales numbers tell us that Americans have figured out how to overcome that struggle.

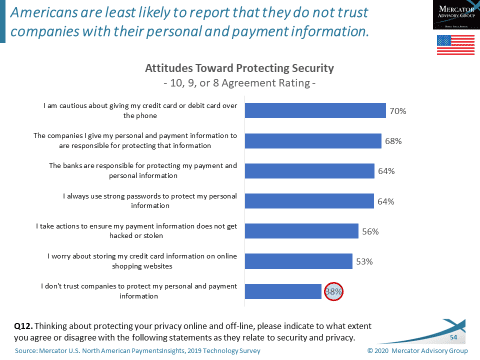

That isn’t to say that consumers don’t have security concerns when it comes to e-commerce. Mercator Advisory Group’s North American PaymentsInsights survey reveals that two-thirds of consumers in the U.S. are using strong passwords and a little more than half are taking action to prevent hacking.

That said, it is also important to note that two out of three consumers place the responsibility of protecting their PII on the e-commerce retailer and on their banks. In other words, a sizable proportion of American shoppers put the responsibility of protecting their information squarely in the hands of other entities. This chart likely would have looked very different 20 years ago.

This leads me to an article I read this morning on Retail Customer Experience which discussed consumer concerns with protecting their personal information while shopping online. In the article, the author interviews the head of sales for Paysafe regarding the results of “Lost in Translation,” a new survey Paysafe published. The gist of the article was that consumers are still very concerned about security in e-commerce.

Paysafe research found a clear pattern has emerged during the pandemic; security is the most important factor for the majority of consumers. Diversifying payment methods and encouraging the use of biometric authentication can shift the perception of security vs. convenience in consumers’ eyes, creating a new wave of e-commerce customers that are a hybrid of both traditional banking methods as well as newer security-centered methods.

While our data was collected pre-pandemic, I doubt the underlying sentiments toward security and responsibility have changed all that much. I haven’t seen anything (e.g., a major breach announcement) that would make me think otherwise.

The interview goes on to talk about the need to make e-commerce transactions seamless while maintaining security, a point I doubt anyone would argue with. The ultimate goal of an e-commerce site is to decrease cart abandonment rate—anything that can be done to accomplish this goal will be widely accepted. That said, overly cumbersome security measures or poorly explained security protocols will damage the convenience and seamlessness of the experience and will likely have negative consequences.

Overview by Peter Reville, Director, Primary Research Services at Mercator Advisory Group