For many consumers, smartphones are an integral aspect of their lives. According to Pew Research Center, 77 percent of Americans now own smartphones, up from just 35 percent from the organization’s 2011 smartphone ownership survey. As consumers have become more comfortable utilizing their smartphones for everyday tasks, many companies have simultaneously enhanced their pay by mobile wallet capabilities to cater to consumer preference. This offering includes any technology that stores payment card information, whether native to your smartphone, or via downloadable third-party payment methods.

Transitioning to Digital

According to the Speedpay® Pulse, a consumer billing and payments trend survey of 3,000 U.S. adults responsible for two or more household payments a month, one in four consumers currently use mobile wallet payment methods and nearly half (47.6 percent) of those people use mobile wallet offerings multiple times a week. Due to an increase in mobile wallet usage, retailers have begun offering loyalty rewards and other incentives, and based on our research, these strategies seem to be working. Of those who use mobile payment methods, 82.2 percent report using one to three methods and applications on a regular basis. The numbers were almost the same for non-payment items, as 80 percent of those who use mobile wallets also take advantage of options such as digital tickets and boarding passes.

Due to the ease and convenience of these offerings, mobile wallets are becoming the new normal, which could eventually remove the need for consumers to pack a physical wallet and smartphone each day.

The Impact of the Mobile Mind Shift

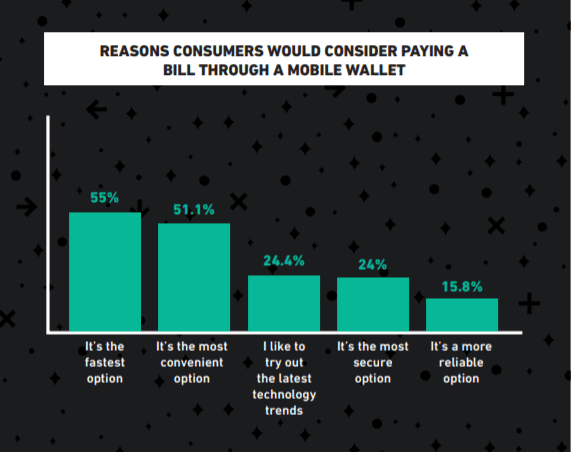

The growing adoption of smartphones and apps has essentially shifted consumer attitudes. Due to this change, mobile wallet payment options have become a necessity for companies, especially because this particular type of transaction is gaining traction for bill pay. Many consumers find that mobile wallet payments provide a simple, convenient payment option, unlike traditional cash and check payments. According to our most recent report, approximately 33 percent of consumers said they would consider using a mobile wallet to pay bills in the future. The top two reasons reported were speed (55 percent) and convenience (51 percent).

Weighing the Option of Adopting Mobile Wallet Payments

Many companies are still reluctant to adopt mobile wallet payments; however, in order to meet the needs of consumers, they should consider implementing mobile wallet offerings. By catering to consumer preference and interacting with them via their smartphones, companies can help ensure an easier and more seamless payments experience. Additionally, the reminders offered via mobile wallet are very beneficial and provide a convenient way to remind their customers to pay. Many mobile wallets have the capability to send monthly statements and notifications directly to a customer’s smartphone, which offers an additional communications channel. Lastly, if companies consider adopting mobile wallets, they will be able to increase self-service and digital engagement among customers, which can lead to a decrease in paper usage and overall operational costs.

Mobile wallet payments will continue to gain popularity in the foreseeable future. Whether customers are paying their bill with a physical debit/credit card or via mobile wallet, it’s recommended that companies constantly communicate with their customers to provide them with a convenient and seamless payments experience.

To learn more about consumers’ mobile wallet payment preferences, download the Speedpay Pulse Trend Report here.

About Alexis Blackstead

Alexis Blackstead is the Vice President of Electronic Products at Speedpay, Inc. (a subsidiary of Western Union®). Alexis has played a critical role in the growth of Speedpay since 1997, where she helped design the company’s core product channels – call center, IVR, web and mobile interfaces – as well as its first logo. Over the last 20 years, she’s overseen several teams including Product, Development, Project Management, QA and Sales Support/Marketing, while spearheading the integration of new features like mobile billing, recurring payments and credit/debit processing. Speedpay currently processes over 200 million payments per year.

Today, Alexis is responsible for managing Speedpay’s product expansion – delivering new channels and innovative mobile solutions for the electronic payments industry.