For those that feel holding bitcoin has an insufficient risk/reward profile there is always the cryptocurrency derivatives market to add spice your life:

“The cryptocurrency market has successfully rebounded from the two-month slump it had gone into from late May to the end of July. Bitcoin (BTC) and Ethereum (ETH) have been leading the charge, posting impressive gains over the last two weeks. The market is seeing price levels that it had reached back in May of this year.

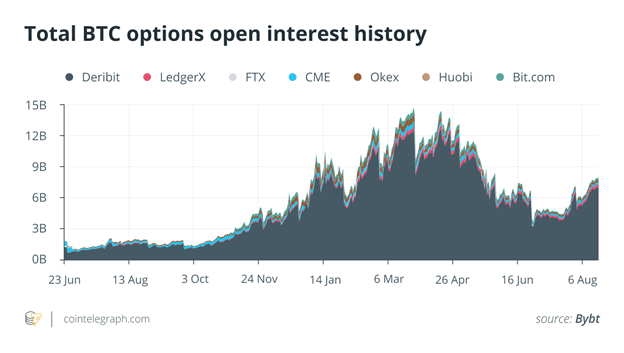

Along with the price gains, the cryptocurrency derivatives market that includes financial instruments like futures, options and even micro futures are also seeing rejuvenated interest from investors. According to data from Bybt, The open interest (OI) in Bitcoin options across all the global exchanges offering the product has more than doubled from the yearly low of $3.63 billion on June 26, hitting a 90 day high of $7.86 billion on Aug. 14.

Cointelegraph discussed this spike in OI with Shane Ai, head of product R&D at Bybit, a cryptocurrency derivatives exchange, who said: “The rise in Option OI is mostly driven by institutional players, and the rising popularity of third-party OTC platforms has facilitated easier execution of multi-legged strategies with deeper liquidity — which are prerequisites for more institutional participation.” Data from on-chain analytics provider CryptoQuant also reveals that institutions are buying BTC in the same manner as they did back in late 2020.

A similar spike in growth is seen in the metrics of the Ether options market as well. The OI in Ether Options jumped 75% from $2.42 billion on 30 July to hit a two-month high of $4.26 billion on Aug. 14. This puts the year-on-year (YoY) growth for this market at 846%.

Notably, the crypto derivatives market is still in the nascent stages of its development, as it only sprung into existence in Q2 2020. Even global investment banking giant Goldman Sachs announced their plans earlier in June to expand its foray into the cryptocurrency markets with Ether options.”

Overview by Tim Sloane, VP, Payments Innovation at Mercator Advisory Group