Corporate payments have moved from the background of several years back to the forefront of fintech and financial institutions’ priorities as we continue moving into 4IR. We have seen high profile B2B strategy reloads from the major card networks as well, with recent financial releases that highlight volume gains in the space. The referenced article in this piece, appearing in an FINSMES posting, reviews the changing space, with a particular emphasis on related impacts associated with latest gen tech. While the author launches the discussion through the lens of open banking, which is more associated with PSD2 in the Euro Zone, it certainly applies to other markets, since the impact of tech is a market reality with distinct competitive implications.

‘If 2018 was the year that heralded the arrival of Open Banking, 2019 is set to be the year that businesses wake up to the payments revolution….New market entrants, stimulated by legislation, regulation and fierce customer demand has nudged traditional players to offer better options too. Best of all, partnerships between the new arrivals and the traditional players is starting to transform how companies do business.’

Not Just Payments

The piece goes on to discuss various improvements available in tech through digital process adoption; areas that have not been traditionally associated directly with an actual payment, such as :

- Accounting efficiencies – data management to improve reconciliation and general cash cycle effectiveness

- Better decisions – using AI (machine learning) for continuous improvement, as well as broader views of information across multiple banks

- FI response – traditional institutions adapting strategies and system to partner with nimble fintechs

- Vigilance – which speaks to risk management 24×7, since faster this means faster that

‘Sadly, the emerging payment trends are not entirely positive. With innovation and the faster transfer of enriched, and consolidated payment data, comes the heightened risk of fraud and financial crime. While corporates stand to gain huge benefits from Open Banking and the new payments landscape, far more education will be needed on risk prevention and the potential for criminal activity.’

Our View

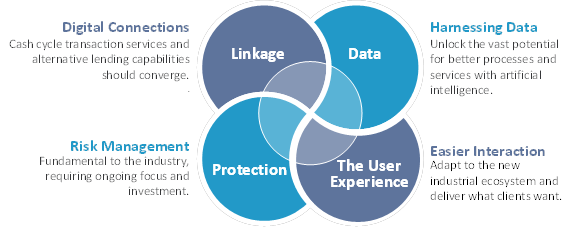

In many ways the article aligns well with our view of success factors for corporate banking and payments as we move into the next decade. In a recent report titled Fintech in Corporate Banking: Digitize or Miss the Boat, we make an argument (reflected in the title) that has these and other points, which is visualized in the image below.

All in all a brief and good overview of a future that is technically already here, but will certainly be more visible soon. Written from the perspective of a well-known industry fintech, and an accurate vision in our view.