August 18, 2022 – New York, NY – Did you know charge volume on virtual cards is expected to grow from $1.9 trillion to $6.8 trillion by 2026? But perhaps more surprising is that B2B spend will make up 71% of that volume. For the last several years we’ve seen the signs of this coming, as neobanks like Brex, Ramp and Divvy have proven that businesses are hungry for modern payment solutions, including virtual cards. And with these new corporate cards came all new spend management features, making it easier for businesses to manage their spending.

However, despite the allure of these new payment experiences, not all businesses are willing to risk leaving their trusted bank partner for a startup bank. As more companies search for digital solutions, 75% of executives believe modernizing payments needs to be a priority. This is where TSYS comes in. In conjunction with its newest partner in innovation, Extend, TSYS is focused on helping bank partners deliver the solutions their customers want by transitioning to a more agile and resilient infrastructure to support the future of payments.

In comes out-of-the-box spend management innovation

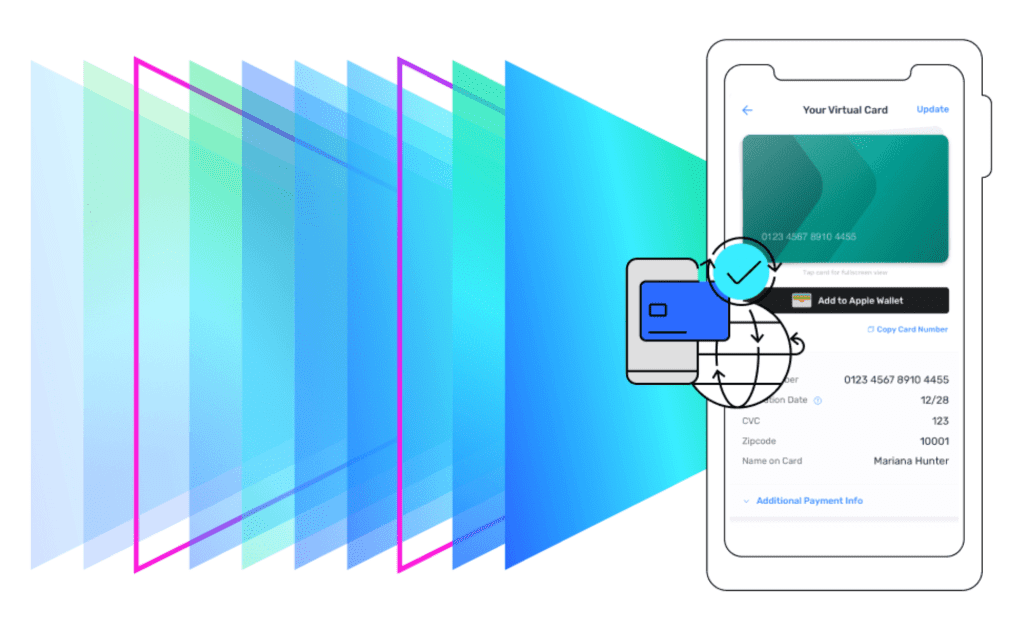

After initially working with TSYS to enable mobile wallet tokenization, Extend now brings the first issuer-agnostic virtual card and spend management platform to TSYS. To make things even easier, Extend is already integrated with TSYS’ Virtual Payment Precept (VPP) solution, which enables the generation of secure, virtual card numbers in real-time with more control over usage and transaction parameters.

For banks, this means they can now offer their business customers a new virtual card and spend management solution along with their existing commercial credit card offerings—with zero technical implementation required. A product that would have taken years to bring to market via in-house development, can now be launched in weeks!

“The payment technology space is becoming increasingly fragmented, but now more than ever banks need a coordinated payments architecture where innovation can thrive,” said Brian Greehan, Head of B2B Solutions at TSYS. “With Extend as a fintech partner, TSYS is prioritizing payment modernization and fostering a more connected financial services ecosystem for our bank customers.”

Business-tested, TSYS approved

Extend’s core offerings include a sleek virtual card and spend management web and mobile app, as well as virtual card APIs for custom integrations. But the best part for businesses is that they can access these services with their existing corporate credit cards.

It’s easy to get started; the company card holder simply registers their card in Extend and can immediately start creating virtual cards on demand and send them to team members or even directly to vendors. Robust card controls allow users to update virtual card details at any time and turn cards on and off as needed. Additional features, such as receipts and attachments, custom reference tags, and expense integrations also help streamline bookkeeping processes and simplify reconciliation.

And while virtual cards mean better control and security for the business, for banks it also means reduced costs and risk exposure compared to issuing plastic.

“The mission of Extend has always boiled down to one goal: to make payment innovation accessible,” shared Andrew Jamison, CEO of Extend. “Together with TSYS, we can achieve this for the industry as a whole—businesses get the solutions they’re looking for while keeping their trusted bank partner and their existing credit cards, and banks can offer competitive payment services without any changes to their tech stack or lengthy vendor onboarding.”

All in the family

This partnership will foster new opportunities for TSYS and Extend to build out additional services and capabilities for our bank partners. While third-party solutions enter the market every day, Extend is the only provider looking to make existing payments infrastructure more connected and more competitive. With Extend, TSYS is reaffirming our commitment to serving issuers and their customers.