Amidst all of the doom and gloom predictions that the COVID-19 pandemic has brought us there is a glimmer of hope in some recent data. A recent announcement from Brian Moynihan, CEO of Bank of America, reports that consumer spending on credit and debit cards is actually up in 2020 compared with 2019.

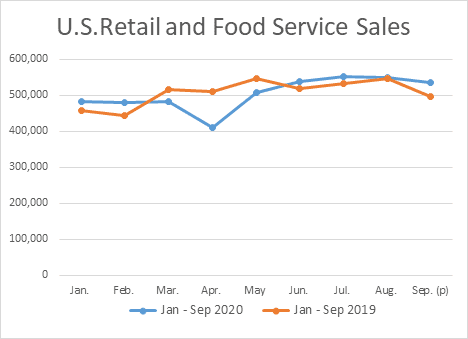

Perhaps not surprisingly, this BofA announcement appears to be in line with the most recently available retail spend data from the U.S. Census. While the Census data takes all types of payments into account (credit, debit, cash, etc.) it does show a similar trend.

As an article in Business Insider points out about the Moynihan announcement:

The issuer anticipated major pandemic losses, but factors like shifting consumer spending habits and stimulus payments helped it avoid substantial losses. In preparation for adverse financial consequences to come as a result of the crisis, the issuer doubled its overall YTD allowance for credit losses in Q2.

Credit and debit card spending volume dipped 11.3% year over year (YoY) in the period, with credit card spending seeing the bigger decline. However, the introduction of government stimulus payments and extended unemployment benefits helped boost volume late in Q2 going into Q3, which saw combined credit and debit card spending grow 2.5% YoY.

Moynihan noted that although spending in key sectors like travel and entertainment remains low—with restaurant dining expenditure down 25% annually, for example—higher spending in other categories, like home improvement, has made up for these declines.

The article also mentions that Moynihan and JPM’s Jamie Dimon are also proponents of another stimulus package. Given the results generated, in part, the first stimulus package, I’m not all that surprised. The infusion of some much cash into the system not only helped the consumers it also proved beneficial to the banks as many consumers chose to spend their stimulus money with a credit or debit card.

Right now the second stimulus package is slated to be about $908 billion assuming the folks on Capitol Hill can come to a consensus. Couple that with increasing consumer confidence brought about by the release of the Coronavirus vaccine. These two factors may help open up some industries, like travel and restaurants, which have been clobbered by the pandemic.

More than ever I think it is critical to keep a close watch on the consumer confidence numbers and the potential for positive momentum in the U.S. economy.

Overview by Peter Reville, Director, Primary Research Services at Mercator Advisory Group