When it comes to payments, there are a few different options available. Debit cards are a popular choice for many people, as they offer a convenient way to pay for purchases without having to carry cash. Credit cards are also widely accepted, and they can offer certain benefits such as rewards points or cash back. However, credit cards also come with the potential for high interest rates and fees, so it’s important to use them wisely. Another option for payments is real-time or faster payments, which allow you to transfer money almost instantaneously. This can be useful for things like rent or utility bills. Overall, there are a variety of payment options available, and each has its own advantages and disadvantages. With all of the options, what do the payment trends look like?

Payment Trends for the U.S.

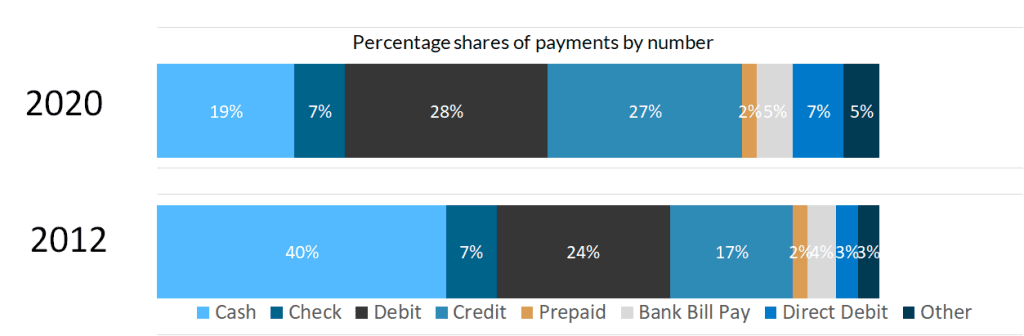

George Bernard Shaw is often credited as the person who said, “Britain and American are two nations divided by a common language”, pointing out that while both countries use the English language, meanings can be quite different. I think there is an analogy here with payment systems. While both the U.S. and the U.K. have similar payments systems available to them, they way that they are interpreted or used is quite different. If we consider data from the Fed’s Diary of Consumer payments, we certainly have seen a decline in the use of cash, but much of that has migrated to cards. The “other category” of new payment networks has grown only slightly in recent years.

Source: Diary of Consumer Payment Choice, table 1. 2012 and 2020

Trends for the U.K.

Compare that to the way that payments are shifting in the UK as outline in this article in Finextra:

A new UK Finance Payment Markets report finds Faster Payments volumes increased by 23% to 3.6 billion from 2020 to 2021. The report looks at the latest payment trends from 2021 and forecasts up to 2031.

While remaining the second most popular payment method accounting for 15% of UK payments in the last year, cash payments are down by 1.7%. During 2021 23.1 million consumers used cash only once a month or not at all, which is a significant increase from 13.7 million consumers during 2020. However, 1.1 million consumers still primarily use cash in their day-to-day shopping.

UK Finance projects that by 2031, cash usage will only account for 6% of all payments made in the UK. They do not anticipate a cash-free society, but rather one where cash is less important.

The number of debit card and credit card payments, which declined in 2020, rose again in 2021 (to 22.9 billion payments), such that 57%of all payments in the UK were made using cards. Debit card payments remain the most common, growing by over 23% to 19.5 billion payments.

The report also includes data on buy-now-pay later (BNPL) for the first time, finding that 12% of people had used BNPL in 2021 with broadly equal numbers of male and female consumers. Younger consumers were more likely to use BNPL than older consumers, although the age group that used it the most was 35 – 44-year-olds.

Overview by Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group