ACH transactions are electronic funds transfers (EFT) that are processed by the network. This network is overseen by the National Automated Clearing House Association (NACHA). Transactions typically take one to two business days to process, but same-day transactions are also available for an additional fee. ACH transactions are used for a variety of purposes, including direct deposit of payroll and government benefits, bill payments, and peer-to-peer payments.

NACHA announced significant transaction growth in second quarter. Two stand-out categories were web initiated transactions and B2B transactions. Digital Transactions reported:

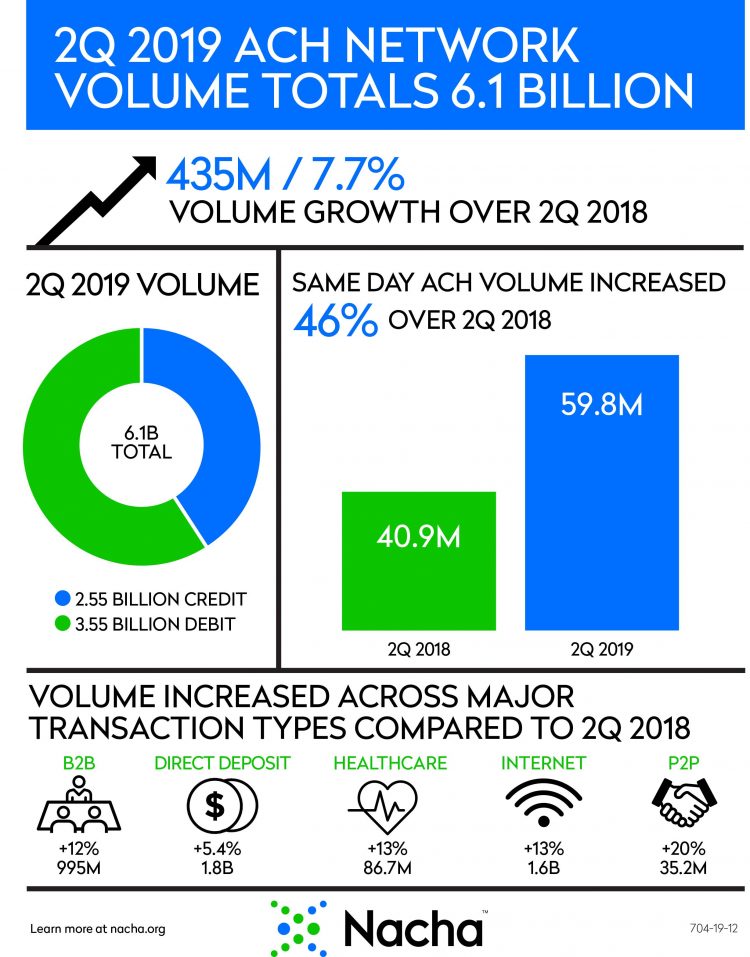

Total volume for the quarter came to 6.1 billion transactions, an increase of 7.7% from the same three months last year, according to Nacha, the Herndon, Va.-based organization that administers the 45-year-old network. The system has been steadily posting 5%-plus quarterly growth rates in recent years as new features such as same-day ACH processing have been introduced.

Contributing to the growth for the latest quarter were transactions Nacha classifies as Internet-initiated payments. These totaled 1.6 billion, up fully 13%. Also helping out were B2B payments, which rose 12% to 995 million.

Since the number of transactions in total rarely increases much, this growth is likely to have come from checks and in the case of internet initiated payments, some card transactions were likely displaced.

Same day ACH also saw real growth in 2nd quarter:

Same-day volume, which is part of the faster-payments trend and has been closely watched since the ACH introduced same-day credits in 2016, jumped 46% to 59.8 million. This volume includes both credits and debits, which were added in 2017. Nacha expects to add a third processing window in March 2021 as part of its years-long effort to facilitate same-day processing.

This volume is likely to be replacing wire transfers and “slow” ACH.

As real-time payments start to grow and get closer to matching the ubiquity of ACH, we will want to watch if same day ACH turns out to be a stepping stone to real-time payments or if the two payments, with notable feature differences, are distinct and operate in specific use cases. We still are a long way off for this type of activity to be noticed and in the meantime, same day ACH and ACH generally is enjoying great growth.

Here’s a link to NACHA’s infographic outlining the details around second quarter’s growth.

Overview by Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group