The days of the email from a “foreign prince” asking for money are no longer upon us, but scammers are still concocting ways to remove money from people. New data indicates that the fraud target is trending away from the elderly to younger adults.

The Australian Competition and Consumer Commission has released data that confirms what the Federal Trade Commission here in the U.S. already announced: scammers have shifted their focus to Gen Z.

According to a recent article in the Courier News out of Australia:

Fake online stores, dodgy ticket sales, sextortion rackets, and Fortnite rorts are among an expanding suite of strategies used by scammers to target Gen Z Australians. The ACCC says Australians under 25 lost more than $5 million to scams in 2019, with reports made from this age group increasing faster than older generations.

About 12,000 of the reports made to Scamwatch in 2019 were from people under the age of 25, an increase of 11 per cent compared to 2018 figures. Reports from this age group increased by 10 percentage points more than any other age group.

Online shopping scams were the most common scams, making up more than 14 per cent of reports and almost 12 per cent of losses among people under 25.

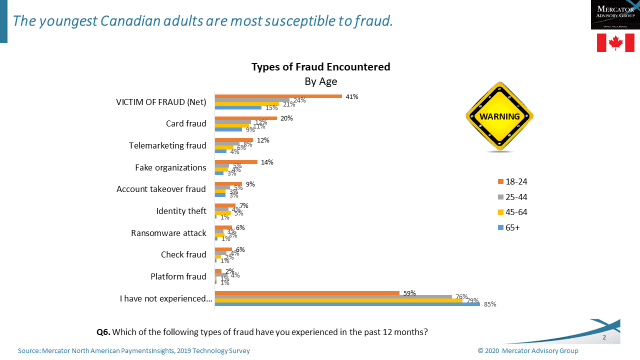

It appears that this issue is not limited to just Australia and the U.S. Our data suggests that Canadian young adults are also more likely to be victims of fraud.

To the grifters, Gen-Z consumers are ripe for the picking for a few reasons:

- They are the digerati and grew up with a connected smartphone in their hand and, as such, are more trusting of the digital world,

- They tend to be heavy users of social media – it’s like shooting fish in a barrel for scammers,

- They tend to have a greater feeling of invincibility, believing that nothing can happen to them.

- They may not be as aware of the different ways they are vulnerable.

I’m sure, given more time, I could come up with more reasons, but this list is sufficient to get my point across.

Scammers will always find the path of least resistance when it comes to their craft. At this point, it looks like the foreign prince grift has run its course and now the crooks have chosen to look elsewhere to do their evil deeds.

Perhaps your good deed of the day could be to let some Gen-Zers know they should be wary. Whether they listen to you, is up to them.

Overview by Peter Reville, Director, Primary Research Services at Mercator Advisory Group