As the economic impact of the COVID-19 pandemic continues to grow, PSCU, the nation’s premier payments credit union service organization, updated its weekly transaction analysis from its Owner credit union members on a same-store basis to identify the impact of COVID-19 on consumer spending and shopping trends.

To provide relevant updates on market performance, experts from PSCU’s Advisors Plus and Data & Analytics teams today released year-over-year weekly performance data trends. In this week’s installment, PSCU compares the 18th week of the year (the week ending May 3, 2020 compared to the week ending May 5, 2019).

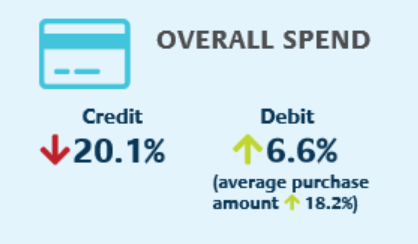

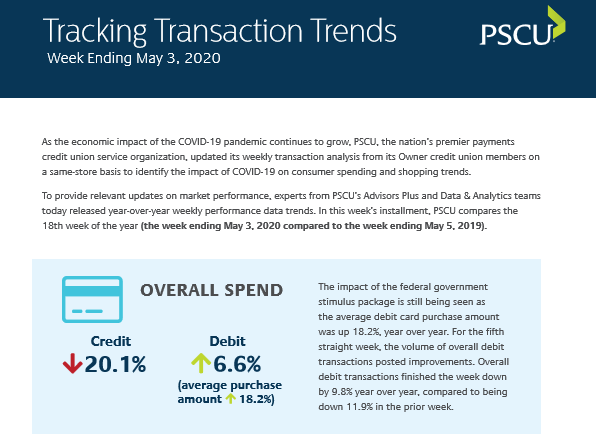

- Overall credit card spend was down 20.1% compared to the same week last year, and overall debit card spend was up 6.6% year over year. For credit, it is the fourth consecutive week of strengthening results.

- The impact of the federal government stimulus package is still being seen as the average debit card purchase amount was up 18.2%, year over year. For the fifth straight week, the volume of overall debit transactions posted improvements. Overall debit transactions finished the week down by 9.8% year over year, compared to being down 11.9% in the prior week.

- The positive trend in consumer goods continued in week 18, with a greater percentage improvement in debit card purchases. In this category year over year, there was a 4.0% increase on credit card spend and an increase of 31.9% on debit card spend for the week ending May 3.

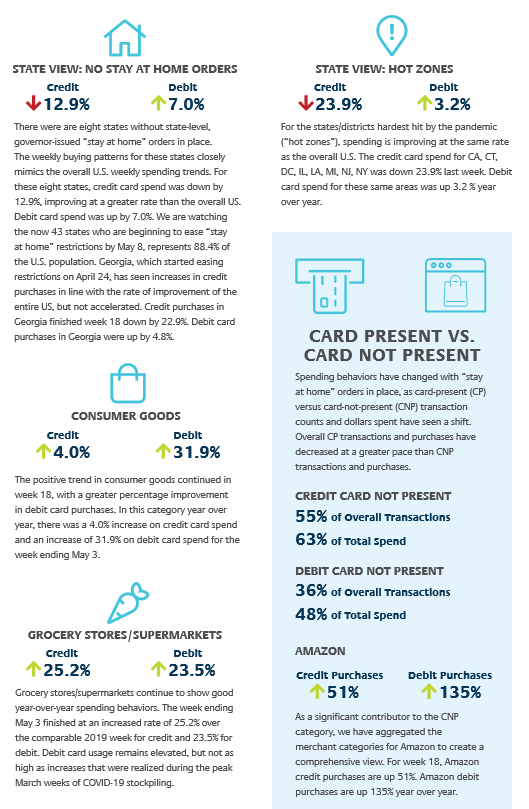

- Spending behaviors have changed with “stay at home” orders in place, as card-present (CP) versus card-not-present (CNP) transaction counts and dollars spent have seen a shift. Overall CP transactions and purchases have decreased at a greater pace than CNP transactions and purchases.

- In week 18, Credit CNP transactions account for 55% of overall credit transactions and Credit CNP purchases account for 63% of the total spend.

- Debit CNP transactions account for 36% of overall debit transactions and Debit CNP purchases account for 48% of the total spend.

- As a significant contributor to the CNP category, we have aggregated the merchant categories for Amazon to create a comprehensive view. For week 18, Amazon credit purchases are up 51%. Amazon debit purchases are up 135% year over year.

- There were are eight states without state-level, governor-issued “stay at home” orders in place. The weekly buying patterns for these states closely mimics the overall U.S. weekly spending trends. For these eight states, credit card spend was down by 12.9%, improving at a greater rate than the overall US. Debit card spend was up by 7.0%. We are watching the now 43 states who are beginning to ease “stay at home” restrictions by May 8, representing 88.4% of the U.S. population. Georgia, which started easing restrictions on April 24, has seen increases in credit purchases in line with the rate of improvement of the entire US, but not accelerated. Credit purchases in Georgia finished week 18 down by 22.9%. Debit card purchases in Georgia were up by 4.8%.

- For the states/districts hardest hit by the pandemic (“hot zones”), spending is improving at the same rate as the overall U.S. The credit card spend for CA, CT, DC, IL, LA, MI, NJ, NY was down 23.9% last week. Debit card spend for these same areas was up 3.2 % year over year.

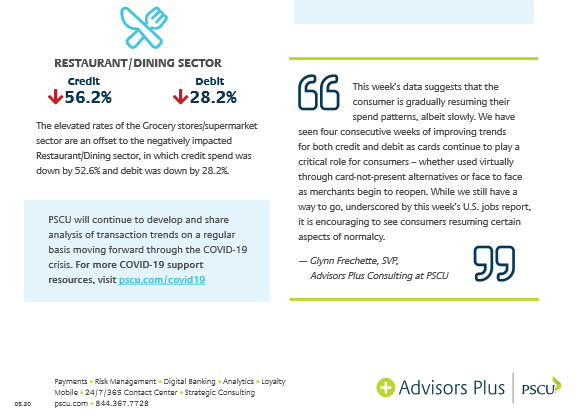

- Grocery stores/supermarkets continue to show good year-over-year spending behaviors. The week ending May 3 finished at an increased rate of 25.2% over the comparable 2019 week for credit and 23.5% for debit. Debit card usage remains elevated, but not as high as increases that were realized during the peak March weeks of COVID-19 stockpiling. These elevated rates are an offset to the negatively impacted Restaurant/Dining sector, in which credit spend was down by 52.6% and debit was down by 28.2%.

“This week’s data suggests that the consumer is gradually resuming their spend patterns, albeit slowly,” said Glynn Frechette, senior vice president, Advisors Plus at PSCU. “We have seen four consecutive weeks of improving trends for both credit and debit as cards continue to play a critical role for consumers – whether used virtually through card-not-present alternatives or face to face as merchants begin to reopen. While we still have a way to go, underscored by this week’s U.S. jobs report, it is encouraging to see consumers resuming certain aspects of normalcy.”

PSCU will continue to develop and share analysis of transaction trends on a regular basis throughout the COVID-19 crisis.