Let’s be honest—the adoption of contactless payments and digital wallets has yet to live up to the hype. Contactless proponents have been shouting from the rooftops that the COVID-19 outbreak is the kick in the pants that consumers need to get off the sidelines and start tapping away. Well, there is some good news and some not so good news on this front.

A recent article in International Business Times discusses how the pandemic has shifted consumers toward contactless usage and AI-driven contactless stores (think Amazon GO stores). Here’s an excerpt from the article:

With the fear of contracting the coronavirus pervading most aspects of daily life, consumers are embracing contactless systems for transactions and spurring the growth of artificial intelligence-driven smart stores.

Coresight Research said the pandemic has forced retailers to innovate, leveraging technology to create a more efficient supply chain and generate growth. At the same time, it has become necessary to reduce contact between employees and consumers, forcing retailers to embrace curbside pickup, cashier-less stores, contactless payment and vending machines.

“The coronavirus pandemic has significantly impacted the ways in which consumers engage in retail, and we expect demand for contact-light shopping to become the new norm,” Coresight said.

There has been a lot of conversation around the increase in contactless use because of the pandemic and consumers’ concerns about catching COVID from the POS terminal. For some consumers, infection via POS is a concern; however, for many, it is not.

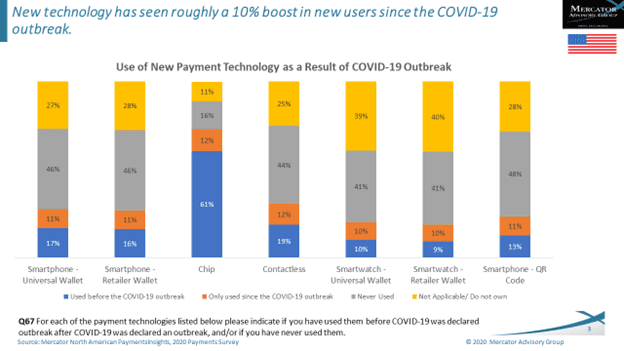

In a North American PaymentsInsights survey Mercator Advisory Group conducted in June, we saw a near 100% increase in the incidence of use of contactless technologies. That said, only about one-quarter of consumers are using contactless payments, even during the pandemic.

Don’t get me wrong, these numbers aren’t minor; a near 100% increase in the usage of anything is a good thing. That said, they sure aren’t the numbers one might expect from reading recent media coverage regarding contactless payments. Articles like the one quoted above, and others, would lead readers to believe that virtually every consumer in the United States is now using some form of contactless payment technology. This simply isn’t true. There is still a long way to go before the U.S. gets to contactless usage levels of other countries. Why and how we get there is a conversation for another time.

Something to think about: How many of the new contactless technology users will continue to use it once the fear of catching a disease subsides?

Despite what might may say or publish, nobody knows the answer this question.

Overview by Peter Reville, Director, Primary Research Services at Mercator Advisory Group