Podcast: Play in new window | Download

You want it? You got it.

With things like television streaming channels, Amazon Prime, and food delivery services, it’s no wonder people have become a little spoiled by convenience. But for merchants trying to satisfy such demanding consumers, the process can be a bit tricky. Fortunately, the implementation of payment orchestration is assisting in giving the customers what they want: a seamless, contactless, and speedy checkout experience.

Recently, ACI Worldwide conducted a research study consisting of interviews with merchants and payment service providers (PSPs) of varying sizes and geographies. According to the data, 57% of merchants are multi-acquiring, meaning they have relationships with more than one acquirer, and 40% of merchants who work with a single acquirer are looking to change this within the next year. As for PSPs, more than 70% of them are already multi-acquiring.

To further discuss the multi-acquirer approach and the benefits of this setup, PaymentsJournal sat down with Benny Tadele, Head of Secure eCommerce at ACI Worldwide and Raymond Pucci, Director of Merchant Services at Mercator Advisory Group.

Why are merchants looking to switch to a multi-acquirer approach?

With the help of COVID-19, there has been a rapid shift in the payments industry. Businesses are shifting to an increasingly digital payments system, which customers have come to expect from merchants. From a consumer perspective, the customer tends to lean toward a mobile-centric checkout experience, meaning they want to be able access payment gateway options like mobile wallets and QR codes. “This digitization has created the need [for merchants] to work with multiple [payment gateway] providers [who] offer the payment types that consumers are expecting the merchant to have right then,” said Tadele.

The payment type is not the only area affected by this shift in the industry. The payments space and retail space are evolving in the wake of a progressively competitive landscape, forcing merchants to continually innovate and adapt to ever-changing consumer expectations. “What that means is to provide that expected customer experience, while at the same time having control over cost [and] providing security and a safe payment journey, merchants need to have this relationship with multiple providers that actually service those in a shifting change,” explained Tadele.

There has also been significant consolidation in the acquiring space, due to mega acquirers and the rise of fintechs, which signifies that there were a lot of options. With PSPs and merchants having cross-border expansions, high risk verticals, increased volume, and a need for multiple payment types, it’s not surprising that there is this new need for multiple acquirers.

“If you pull that all together, what our research and experience is showing is [that merchants and PSPs have] to have a resilient payment infrastructure [and] flexibility to adapt to the needs of the consumer, as well as the industry,” continued Tadele. This will not only increase customer satisfaction at the point-of-sale, but also drive up customer loyalty and the value of each customer.

Benefits of a multi-acquirer approach for merchants

In the last couple of years, the ACI Worldwide has seen about a 60-70% adoption rate of its capability, which it calls “Smart Routing.” Smart Routing focuses on optimization of approval rate and conversion rate through the use of multiple acquirers through an online payment gateway. “That data alone tells [us] that merchants are seeing tangible results in having a multi-acquirer result,” said Tadele.

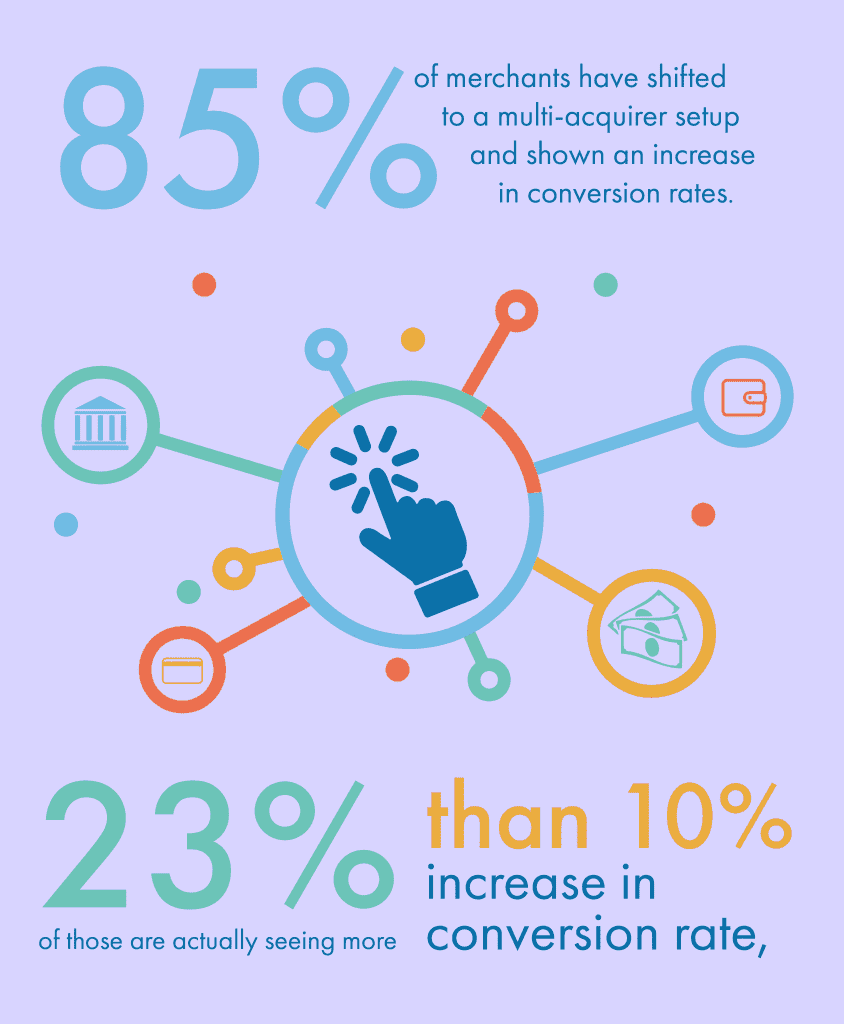

One specific use case from ACI Worldwide suggested that 85% of merchants have shifted to a multi-acquirer setup and shown an increase in conversion rates. “And if you quantify that, about 23% of those are actually seeing more than 10% increase in conversion rate,” added Tadele. “Multi-acquirer setup absolutely brings an uplift in conversion rates.”

Even bigger than the actual revenue is the loyalty of the customer. Good customer experience results in the repeated business of that customer, and increasing the conversion rate directly correlates with that experience. Further, there’s been a 12-16% increase in conversion rates when a smart dynamic routing capability in place across the ACI database.

Another example provided by Tadele referenced a global customer that was leveraging a super acquirer, which is a single acquirer that addresses multiple markets and geographies. The upside of a super acquirer is in its simplicity; there’s no need to manage multiple contracts. “However, after looking at the data, and some of the conversion challenge, we converted one specific market that’s strategic and critical for this customer into a local acquirer over a period of time, having checks and balances to make sure [ACI Worldwide had] a backup between the global and the local,” explained Tadele. Once completed, within an eight month period, it saw a 42% increase in the acceptance rate for that market.

“Imagine the customer experience and loyalty impact that would have,” concluded Tadele.

How can merchants simplify this setup?

Consumers have grown very accustomed to the on-demand experiences they’ve been exposed to. Additionally, they’ve come to expect a variety of options, both in stores and online. This has led to the expectation of a seamless experience from the online payment service providers.

There are also increasing pressures on merchants to keep up with the growing complexity of the payments ecosystem, provide offers and incentives, and mandate security regulations to mitigate fraud risk. Having a multi-acquirer gateway and the right technology partner adds value and simplifies the process for businesses. “On the one hand, [this] allows you to be flexible, so that you can innovate all the customer journeys and all the experiences you need to bring to your consumers,” said Tadele. “But at the same time, [it] helps [the merchant] to abstract out the complexity, the security requirement, and the overhead that really comes from truly getting plugged into the payment space.”

The leveraging of these types of gateways is growing into a payment orchestration engine. With the right payment orchestration engine, merchants can expect to connect to multiple acquirers dynamically while being protected from fraud. “Whether [the merchant] wants to enter a new market or enter a new vertical, or [they] want to enable a new payment, it’s not another integration effort,” offered Tadele. “It’s not another technical exercise, but it’s a matter of configuration and switching and flags that allow [merchants] to quickly enable those functionalities, offers, or services for consumers.” The benefits of this multi-acquiring strategy drives conversion and better controls costs, allowing for companies to better negotiate with acquirers. And these benefits seems to outweigh some of the complexity challenges and disadvantages. “If [merchants] can bring [secure] the right payment orchestration engine in place, then [they] would be able to drive it without that dragging you down,” concluded Tadele.