Real-time payments have found successful applications in the payroll industry. When employees need to be paid right away to correct an error or to quickly forward their last payroll, real-time payments reduce the friction and cost of handing a check to an employee or sending a wire. Much has been written about the opportunity to use real-time payment transactions to pay gig economy or contingent workforces by the task or multiple times a day, which helps employees meet their financial obligations and creates a positive work experience. An article in PaymentsSource suggest that the two week or monthly payroll cycle that most employees experience is the next transaction that will change:

“Consumers and businesses would rather get paid instantly,” said Drew Edwards, CEO of digital payment platform Ingo Money. “We have the point of view that we have this end-to-end platform that allows a bank or business to offer the consumer the same kind of experience when being paid that they are used to when they go buy something and have a choice of the way to pay.”

The desire to get paid instantly will advance beyond the gig economy, Edwards said. Ingo has long tried to help banks and businesses move into a digital-money landscape, and Edwards predicts that within two years, the two-week payroll cycle and delayed invoice payments could be a thing of the past.

There’s plenty of momentum to support that prediction. It’s a growing industry featuring end-to-end platform providers, P2P options like Zelle, Venmo and Apple Cash and major network gateway providers moving to faster payments as a way to serve all consumers and businesses.

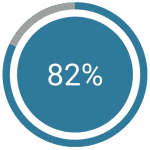

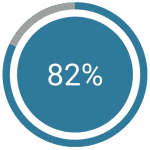

No doubt more employees will be paid on a faster payroll cycle. It is becoming a real differentiator in some scenarios with a tightening jobs market. But changing the two week pay cycle for traditional salaried and hourly workers will take more than faster transactions. According to NACHA, 82% of US workers are paid electronically already through direct deposit. Changing that decades old process including the deduction of Federal, State, Local and other tax obligations with each pay and accounting for deductions for insurance and savings requires effort. That’s one reason so many employers outsource the task and pay a processor to manage the task. Will employers foot the bill for running payroll everyday instead of twice a month? Doubtful in the near term.

Overview by Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group