Several months back, American Express announced a partnership deal with Amazon to issue a co-branded credit card for small businesses, reportedly winning out over JP Morgan Chase, among other bank card issuers. In a press release earlier today, the company announced the actual product launch for bearing first fruit in the partnership, which is branded as the Amazon Business American Express Card. The card has a host of rewards and other features for incenting usage, particularly through Amazon sites such as Amazon Business and Whole Foods.

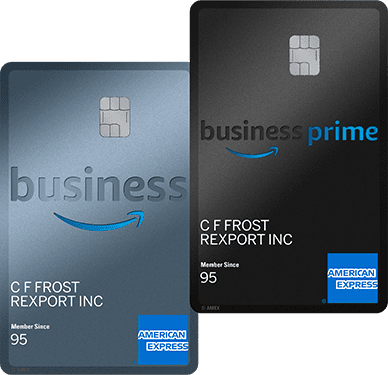

In order to gain some additional insight, Mercator was able to speak with Amex’s Evan Lubeck, Vice President of Commercial Co-brand, Global Commercial Services. In their research and ongoing discussions with small business owners, Amex finds that both easing the buying routine and working capital are key priorities for this business segment. The product is mostly targeted towards companies with annual revenues of $10 million and below. An interesting feature is that when buying through Amazon Business and Amazon.com, the card offers an enhanced checkout experience giving business owners a choice of benefits, purchase by purchase. They can choose between either earning rewards or applying interest free terms to their purchase, essentially providing some optional cash flow support. The ability for business owners to capture line item detail on Amazon purchases is also a valuable tool for ease of financial reconciliation. The application process is an entirely digital experience, accessed directly through the Amazon site. Once approved, a tokenized version of the card is automatically included in the business owner’s wallet for use during the Amazon buying experience. As one can see in the image accompanying the article, the Amazon Business American Express Card has a unique vertical design, which according to a company spokesperson ‘is an analogy for turning business buying on its head’.

For a number of years the SME market was generally underserved by financial institutions regarding the types of product solutions available. The SME space was typically caught between more lucrative retail and corporate banking businesses, while small business product solutions defaulted to ‘mashups’ of consumer products on steroids or corporate products on weight-loss programs. In the fintech era this has been rapidly changing and this is an example of innovative approaches that utilize modern technology to deliver relevant small business solutions.

Overview by Steve Murphy, Director, Commercial and Enterprise Payments Advisory Service at Mercator Advisory Group