Does your company have a consumer facing presence? If so, is you mobile app all it can be?

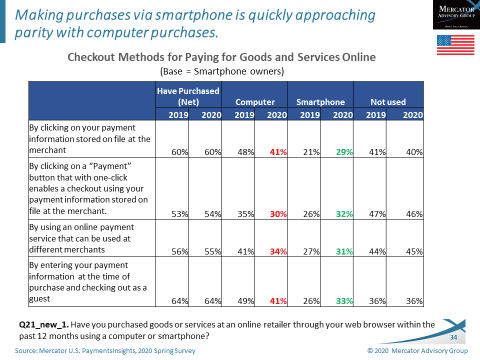

Recent reports from Mercator’s Buyer PaymentsInsights Study and Mercator’s PaymentsInsights Study have demonstrated that there is a real shift in consumer behavior with regard to the use of mobile to make purchases. The graph below demonstrates the shift from computer to smartphone to make purchases.

This shift to mobile is not just a payments issue it is a global shift in consumer behavior that is only going to accelerate. A recent article in Tech Crunch, App stores to see 130 billion downloads in 2020 and record consumer spend of $112 billion, does a good job of explaining the shift using data from App Annie’s year end forecast. If you do some very simple math, that averages about 17 app downloads for every man, woman and child on the planet.

The article cited several reasons for this global shift:

Due to the COVID-19 pandemic, mobile adoption accelerated by two to three years. As a result, consumers increasingly turned to apps as digital solutions for work, education, entertainment, shopping and more. This resulted in the rise in downloads, time spent on mobile and consumer spending — despite there being more maturity in the mobile market.

Consumers are also spending more time on their phones:

Also due to COVID-19, consumers spent more time on devices — a metric that saw a significant 25% jump from 2019 to top 3.3 trillion hours on Android. (App Annie cannot measure the figure on iOS.)

As the article mentions the pandemic only hastened a consumer shift that was brewing long before any of us knew what COVID-19 was. Increasingly smartphones were becoming an extension of our arms. There was a statistic going around a few years back that consumers would be more upset about losing their smartphone than their wallet.

If you want to see an example the importance of smartphones in people’s lives, just take public transportation (please wear a mask), heads are down, and eyes fixed on a smartphone. This behavior is repeated everywhere.

While I can go on about the importance of smartphone to today’s consumer, I think the point is made. The bigger point to be made is in the questions at the beginning of this article. What is the current state of your app? Let’s take it one step further, what does your website look like on a 4.5” screen? Can both perform the tasks you want consumers to do, seamlessly and securely?

Overview by Peter Reville, Director, Primary Research Services at Mercator Advisory Group