For industry professionals and consumers alike, innovation in the payments industry might feel like it’s at an all-time high, with new artificial intelligence (AI) and mobile technologies and tools emerging every day to make the bill pay process faster, easier and more convenient for consumers.

However, according to Speedpay® Pulse, a consumer billing and payments trends survey of 3,000 U.S. adults responsible for two or more household payments a month, consumers still prefer more traditional payment options, like paying on a biller’s website, to the variety of new digital offerings. These findings are especially true for auto finance consumers, who on average pay their auto bill more frequently through their biller’s website compared to other payments, like their mortgage or credit card bills.

This poses a challenge for auto finance billers: How can they educate consumers to feel more comfortable with emerging payment methods without losing sight of their traditional preferences? After all, new technology should add speed and convenience to consumers’ lives, not confusion and apprehension.

Clearly Communicate New Offerings

New technology can be intimidating, especially considering the speed at which products and tools are released for public consumption. Jargon such as “the cloud” and “AI” tossed around by industry leaders and the media can often lead to more confusion.

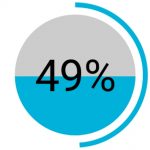

For example, according to data from Speedpay® Pulse, fewer than half of consumers say they’re confident they

are familiar with AI. In fact, roughly the same number (49%) say they’re too unfamiliar with AI tools to pay a bill using it.

For consumers to feel more comfortable and familiar with an emerging payment method or technology, auto finance billers should remove the mystery surrounding it. It’s up to the biller to clearly explain through consumer communications what a new product is and how consumers can start using it. Billers should tout the benefits of these tools, including speed and convenience, to demonstrate how they can make consumers’ lives easier when it comes to making an auto loan payment.

Update Traditional Payment Tools

While some consumers are open to adopting new technologies, others prefer to stick to more conventional methods of bill presentment and payment – especially in the auto finance industry. Diversifying and expanding payment methods is all about giving consumers choice, but that doesn’t mean letting traditional payment methods fall to the wayside.

In order to cater to consumers who are most comfortable paying their bills in a traditional way, like on their biller’s website or by phone, it’s important that the customer experience is top quality. That means keeping more traditional means of bill pay free from bugs and technical issues and providing excellent consumer service over the phone.

No matter how an auto finance consumer chooses to pay, it’s up to payment providers to deliver the best experience possible to encourage consumers to make timely and consistent payments – a winning solution for everyone involved.

To learn more about consumers’ auto finance payment preferences and other findings from the Speedpay® Pulse, click here.