Bank of America today announced that it has enhanced its accounts receivables matching solution. The solution is Bank of America Intelligent Receivables™. It offers additional reporting and new forecasting capabilities. It also provides clients with insights based on historical trends and their customers’ behaviors. The bank also announced that it has completed the global roll out of Intelligent Receivables. This is with the product’s launch in Brazil.

Intelligent Receivables uses artificial intelligence (AI) and advanced data capture technology. It brings together payment information and associated remittance detail from various payment channels, whether electronic or paper based. It has the ability to grab data from multiple sources (including emails and attachments). Intelligent Receivables will seek to match payments to outstanding invoices. It helps to meaningfully reduce the costs normally associated with manual processing. It also speeds up the posting of revenue.

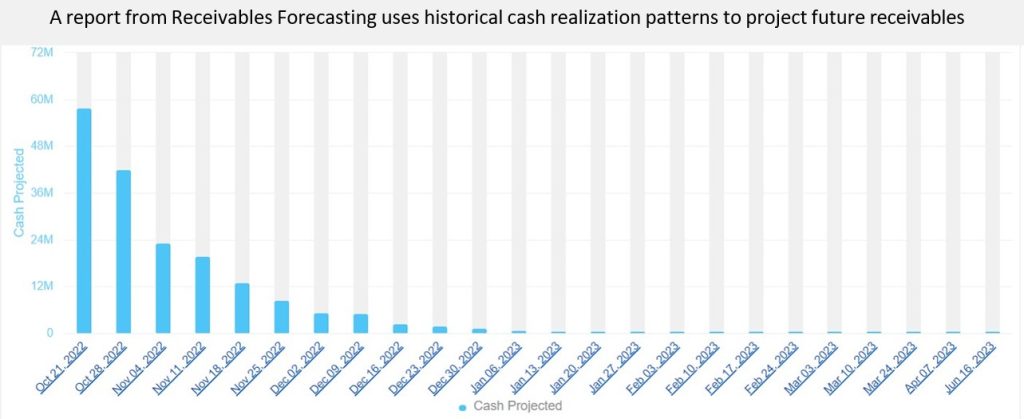

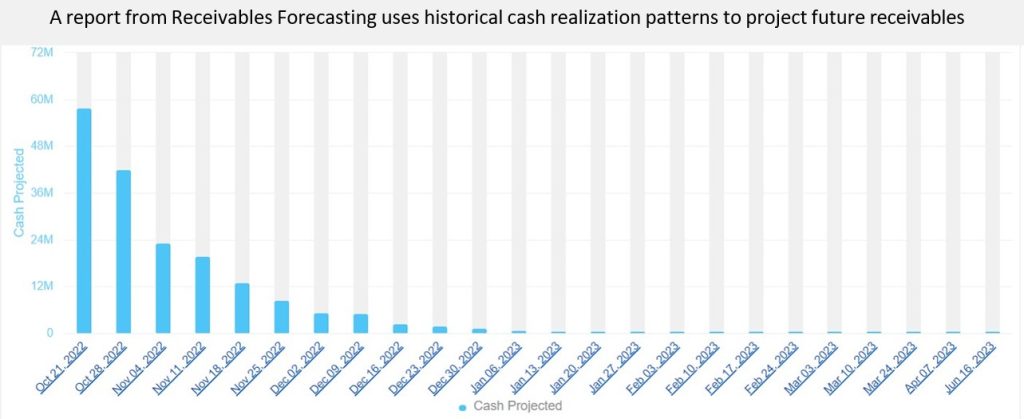

AR Forecasting Capabilities

“The new capabilities are a natural extension of a tool that constantly interacts with data,” said Liba Saiovici, head of Global Receivables in Global Transaction Services (GTS) at Bank of America. “The new dashboards give clients a more comprehensive view into their total collections and outstanding receivables from which they can dig further to better understand their customer’s behavior around timeliness and preferred mode(s) of payment.”

Around the world, Intelligent Receivables is increasingly being used by large and medium sized companies in nearly all industries. Bank of America has made continual improvements to the tool since it was launched in 2017. Last year they added new language processing capabilities, including Simplified Chinese, Traditional Chinese, Korean and Thai. Portuguese is also available to support clients in Brazil.

As an indicator of client engagement, Intelligent Receivables last year processed ~43 million invoices. This is a ~50% increase from the year earlier. “The growth in adoption of Intelligent Receivables is a testament to the tool’s impact on a company’s bottom line,” said Fernando Iraola, co-head of Global Corporate Sales GTS and head of Latin America GTS at Bank of America. “We’re confident that clients will see even greater value from using the tool with its new reporting and receivables forecasting capabilities.”

Bank of America

Bank of America is one of the world’s leading financial institutions. They serve individual consumers, small and middle-market businesses and large corporations. These corporations have a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 68 million consumer and small business clients with approximately 3,900 retail financial centers, approximately

16,000 ATMs and award-winning digital banking with approximately 56 million verified digital users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 3 million small business households through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and approximately 35 countries. Bank of America Corporation stock (NYSE: BAC) is listed on the New York Stock Exchange.

“Bank of America” is the marketing name used by certain Global Banking and Global Markets businesses of Bank of America Corporation. Lending, other commercial banking activities, and trading in certain financial instruments are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., Member FDIC. © 2022 Bank of America Corporation. All rights reserved.

For more Bank of America news, including dividend announcements and other important information, visit the Bank of America newsroom and register for news email alerts.

###

Reporters May Contact:

Louise Hennessy, Bank of America

Phone: 1.646.858.6471

louise.hennessy@bofa.com