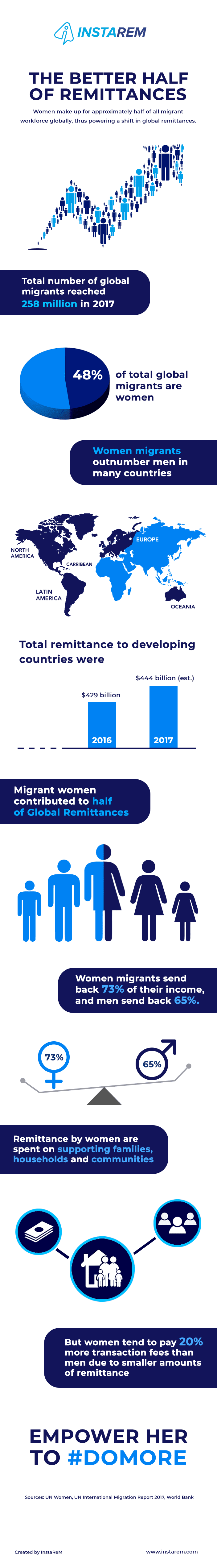

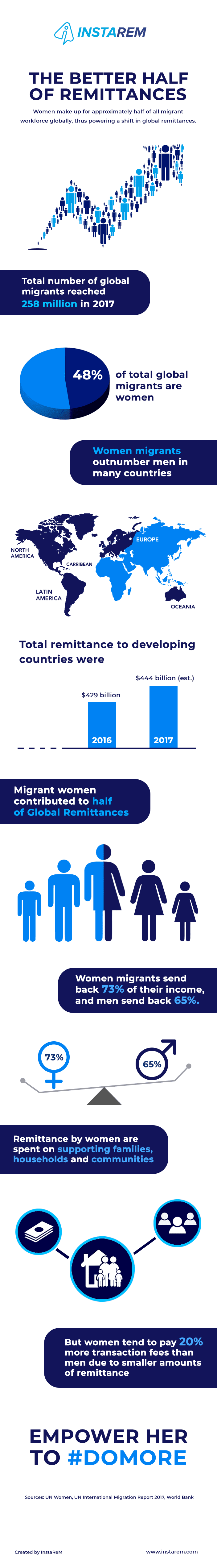

From flying an aircraft, fighting for the honour of their country, to leading the pack in innovation & entrepreneurship, women around the world are breaking gender stereotypes every day. Yet, women continue to battle the stigma of being the ‘weaker’ sex in many spheres of life — the most important being financial credibility. Be it the gender pay gap or the ability to support her family, a woman’s contributions are always considered to be ‘lesser’ in comparison to her male counterpart.

The international remittance industry is no different. When it comes to overseas money transfers, the general perception is that it’s men who move out of their home country to support their families, as is evident in the following case: Jesus Cervantes of CEMLA writes, “it is commonly thought that remittance flows (…) stem from a migratory process where men leave their country to seek better employment and income opportunities, and then send remittances to their wives and children back home.”

Now comes the surprise — women not only contribute to half of the global remittances, but also remit a larger share of their income than men! On the occasion of International Women’s Day, we are out to debunk some common theories about women and remittances.

Since women remit smaller amounts more frequently, they end up paying 20% more transaction fees than men. This Women’s Day, InstaReM pledges to empower women to #DoMore by offering cost-efficient and easy overseas money transfers. More power to you!

About IntaReM

InstaReM is a Singapore-headquartered cross-border payments company. Founded in 2014, InstaReM is licensed as a Money Services Business (MSB) in Singapore, Hong Kong, Australia, Malaysia, India, Canada and US. It powers local payments to more than 55+ countries across the globe. InstaReM has created a unique payment mesh in Asia, which is being leveraged by financial institutions, SMEs and individuals to make fast low-cost cross-border payments. Since starting operations in August 2015, InstaReM has raised US$ 18 million in two round of funding. Its investors include Global Founders Capital, Vertex Ventures (VC arm of Temasek Holdings), Fullerton Financial Holdings, GSR Ventures and SBI-FMO Emerging Asia Financial Sector Fund.

For more details please visit www.instarem.com