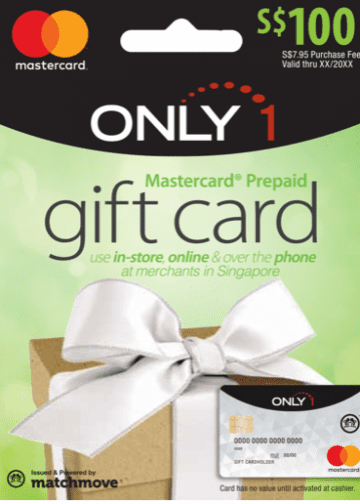

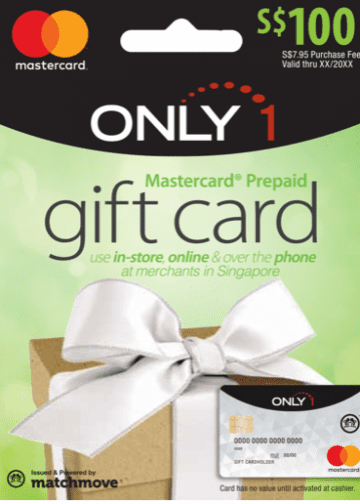

MatchMove, one of the world’s fastest-growing and leading fintech companies, today announced that it has partnered with Blackhawk Network, a global financial technology company and a leader in connecting brands and people, to launch the “Only 1® Mastercard Gift Card” in Singapore. Powered by MatchMove’s proprietary Banking Wallet OSTM, Only 1® Mastercard Gift Card is perfect for smartphone users who do not have access to online banking, credit cards or other digital payment methods, or those who prefer not to use credit or debit cards but want to enjoy digital commerce. The payments solution lets users spend across e-commerce sites and brick-and-mortar shops island-wide where Mastercard is accepted while enjoying the unique “Dynamic CVC” security feature.

Students, domestic helpers and foreign workers in Singapore can purchase the gift card and use it at eligible merchants across Singapore where Mastercard is accepted. When shopping online, the Dynamic CVC feature enhances the security level of online payment where a new CVC code will be generated for each online transaction. In addition, digital payment methods allow users to keep track of their expenses via Only 1® Mastercard Gift Card’s website.

“We are pleased to partner with MatchMove on the launch of the Only 1® Mastercard Gift Card in Singapore,” said Nick Sadlier, Country Manager, Singapore, Blackhawk Network. “The Only 1® Mastercard Gift Card expands financial inclusion for the unbanked or cash customers, and enables them to enjoy the convenience of shopping online ― just in time for the festivities.”

Deborah Heng, Country Manager, Mastercard Singapore, said, “As the world becomes more digitally led, the Only 1® Mastercard Gift Card is the ideal way to cater to the financial needs of consumers, including international students, domestic helpers and foreign workers. With Mastercard widely accepted globally, this strengthens our ability to drive inclusive growth and positively impact the underbanked, enabling them to enjoy shopping both online and in store in a safe and seamless manner anywhere in the world.”

Shailesh Naik, Founder & CEO of MatchMove, said, “We are delighted to add another leading global company to MatchMove’s list of trusted partners. Being the engine behind Only 1® Mastercard Gift Card helps us to empower the financially underserved segments to enjoy shopping anywhere, anytime, in today’s app world.”

Only 1® Mastercard Gift Card can be purchased at over 70 New Post Network’s quick service stores and kiosks island-wide. The gift card value is available in SGD 88, SGD 100 and SGD 200 denominations.

To make purchases online or over the phone, users need to visit the website www.only1giftcard.com.sg to register the gift card with the 16-digit card number, mobile number and a password.

Only 1® is a registered trademark of Blackhawk Network in Australia and a pending trademark of Blackhawk Network in Singapore.