In many ways, the subscription economy is the dominant force in the U.S. today. Most consumers are managing dozens of subscriptions monthly or annually. These are from streaming services to online video game network access. They also include retail, culinary, alcohol, and much, much more.

One study from the summer showed that the average consumer spends $219 monthly on subscriptions. The average consumer manages 12 subscriptions in just the media and entertainment category alone. Furthermore, 42% of consumers are paying for at least one subscription they have forgotten about and no longer use.

Unfortunately, subscriptions aren’t without their problems. Payment issues like declines and chargebacks can be a significant drain on revenue for subscription businesses. A new whitepaper from Chargeback Gurus, in conjunction with Juniper Research, looked at some of the trends in this area. It also looked at what subscription billers can do to reduce chargebacks and declines.

Subscriptions — and Associated Fraud — Continue to Rise

As popular as subscription services are at the moment, they are only going to continue to rise in consumer adoption. Growth of more than 200% is expected from 2022 to 2026, according to the Chargeback Gurus whitepaper. At the same time, illegitimate chargebacks — also known as friendly fraud — have also risen. This was the fastest-growing type of fraud from 2019 to 2021, according to the Merchant Risk Council.

“As merchants across industries expand their subscription billing operations, mitigating the risks posed by chargebacks will be key to long-term success,” the whitepaper stated.

Subscription models are often thought about as used in streaming and media services. But their popularity has extended to other sectors. This even includes physical goods. Some examples of the latter can include wine-of-the-month clubs or recurring food delivery subscriptions. The chart that follows details the most common categories in the subscription economy.

“Subscription payments are less volatile than one-time purchases, so companies that implement this business model can reliably predict revenue as payments are scheduled,” the whitepaper stated. “Subscriptions also increase customer retention by making repeat purchases automatic.”

However, with a business model based on automatically recurring payments, there is risk of declined payments, which can be due to a variety of factors such as a consumer’s card information being out of date or a lack of funds in an account.

What Affects the Payment Acceptance Rate?

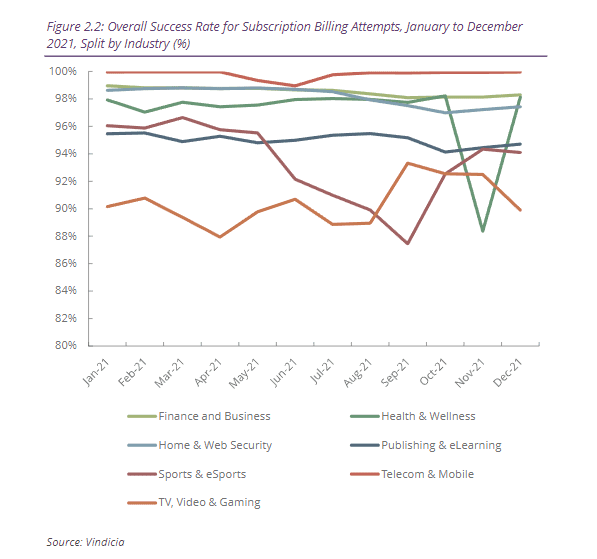

Of the industries included in the data, telecom has the highest payment acceptance rate. The rate is 99.8%, with TV, video, and gaming rating the lowest, at 90.9%. The study also found that decline reasons are often difficult to interpret for merchants, adding to the challenge of reducing overall decline rates.

The telecom industry has the highest acceptance payment rate because it has used subscription billing for decades and has “had the time and resources to thoroughly optimize their billing practices.” Another factor is that when consumers must make difficult budgetary decisions, they are likely to cancel nonessential subscriptions such as a streaming or media service as opposed to their phone.

Unfortunately for merchants, decline responses do not provide much information, which can make figuring out how to prevent future declines challenging, the whitepaper noted. “Insufficient funds” makes up a significant percentage of declines in the financial services industry, indicating that this is a major issue in that sector. Both “credit floor/insufficient funds” and “do not honor” are common decline codes across multiple industries.

The Problem of Customer Churn

Customer churn is a reality in any industry but pronounced in the subscription economy. Subscriptions often feature promotional rates to attract new customers, who then cancel when the rates go up. Also, subscriptions may be canceled after a specific movie is watched or game is played.

Then there is the sheer competition for the consumer dollar. The whitepaper noted that “the subscription market is highly competitive, especially in industries such as video steaming. There have been numerous cases where services grew rapidly, then saw a decline in user numbers as competition increased, with Netflix being one notable example. As such, there may be a high rate of churn as users change to competing services.”

Chargebacks and How to Fight Them

Chargebacks are a big concern in the subscription economy. They were initially created as a way to fight fraud, enabling cardholders to get their money back in fraudulent transactions.

However, many chargebacks are the result of “friendly fraud.” This is also known as first-party fraud. Friendly fraud is where a transaction was legitimately made and authorized by the actual purchaser. But they still requested a chargeback, potentially misrepresenting the situation with the merchant. They did this to get back their money. For example, consumers can say that an item didn’t arrive when it did, or that a service didn’t work properly. The cost of combatting friendly fraud can be high for merchants. It can be difficult to detect or prove because the perpetrator is an actual customer and not a fraudster.

There’s also the case of “family fraud,” where card details are saved in an account and then additional subscriptions are taken out by family members without cardholders’ knowledge. These instances can also be time-consuming and costly for merchants to fight.

Another big issue with subscriptions is the auto-renew nature of most of them.

“Where this renewal is monthly, this is not too noticeable, but this is very noticeable if the recurring payment is annual,” the whitepaper stated. “As such, users are very likely to question large, unexpected payments even if the terms and conditions did actually spell this out.”

How Merchants Can Combat Chargebacks

Though chargebacks present a significant issue for those operating in the subscription economy, tools and services can be used to help mitigate this concern, the whitepaper advised.

For one, merchants can leverage robust data analytics tools to help identify hidden trends in their chargebacks, thus reducing their workload and their revenue loss. Merchants can also build internal processes that enable them to bring the best and most robust evidence forward to fight chargebacks. To do this, merchants can consult with experts in chargeback management who can audit chargeback strategy, provide industry benchmarks, and make recommendations for process improvements.

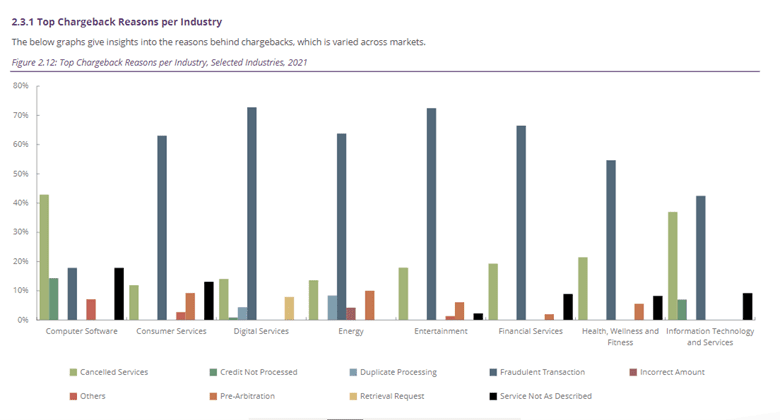

Perhaps most important is working with a vendor that knows your industry. The situation across industries can be very different, with some sectors facing much higher chargebacks and declines than others. As such, it can be advantageous for merchants to choose a partner that understands the nuances of their particular industry.