The recent rise of contactless payments in the U.S. is one of the most buzzed about topics in the payments industry. If the headlines are any guide, the rise of contactless has been rapid and substantial, signaling the ascendance of a new payment method at the expense of existing ones. The story goes that in order to avoid touching germ-infested point-of-sale (POS) terminals, consumers have flocked in droves to contactless payment methods.

However, a recent blog post from Sarah Grotta, Director of Debit and Alternative Products Advisory Service at Mercator Advisory Group, challenges this narrative. She points out that in the majority of these articles, “there is a reluctance to share the actual number of contactless transactions.”

Many articles rely on consumer surveys, which help reveal general trends without providing insight into the number of transactions. Other articles report the percentage growth of transactions between 2019 and 2020, which is potentially misleading given that contactless transactions made up around two percent of all transactions last year; a sharp rise in the percentage growth does not necessarily reflect a significant rise in overall transactions. And finally, articles that do provide transaction data often cite global numbers, including data from countries where contactless is already a mature product, meaning that the situation in the U.S. remains unclear.

Better data does exist

Grotta points out that the one notable exception to the lack of solid data is PSCU, a Florida-based credit union service organization. PSCU has been tracking and publishing data on contactless activity each week. PSCU has been tracking and publishing data on contactless activity each week. Grotta notes that although “PSCU’s data represents member transactions from their owner credit unions, the data do represent a mix of transactions from across the U.S. and include cardholders from rural, suburban, and urban locations.”

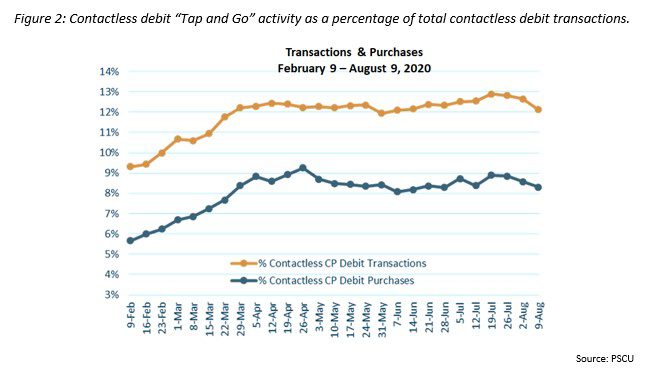

Given that the data come from a mix of transaction types from across the country, PSCU’s numbers offer a deeper insight into the state of contactless usage in the U.S. And what the numbers reveal is that while contactless adoption may not be skyrocketing, as the headlines purport, there does appear to be modest growth.

For example, when the lockdowns first began around March 15, contactless debit transactions comprised 11% of all in-person debit transactions. By mid-July, it ticked up to 13% before dropping slightly to 12% in the beginning of August. As Grotta notes, “While these growth numbers don’t necessarily provide a sizzling headline, this is good growth as it represents a change in consumer behavior, which often can take years to accomplish.”

Grotta goes on to explore what the data reveal about mobile contactless payment usage, the frequency of contactless usage in small dollar transactions, and overall transaction volume trends.

Those interested in the other trends Grotta identified in PSCU’s data can view her blog post here.